- Web3 Investor Briefing by w3.group

- Posts

- Web3 Investor Briefing | July 2025

Web3 Investor Briefing | July 2025

Every month we provide you with insightful deep-dives into the world of Web3 investing.

Welcome to this month's investor briefing featuring our latest analysis, findings and strategic insights from the Web3 ecosystem.

TL;DR

Julius from w3.wave discusses the recent Bitcoin breakout and what to expect next from the crypto markets.

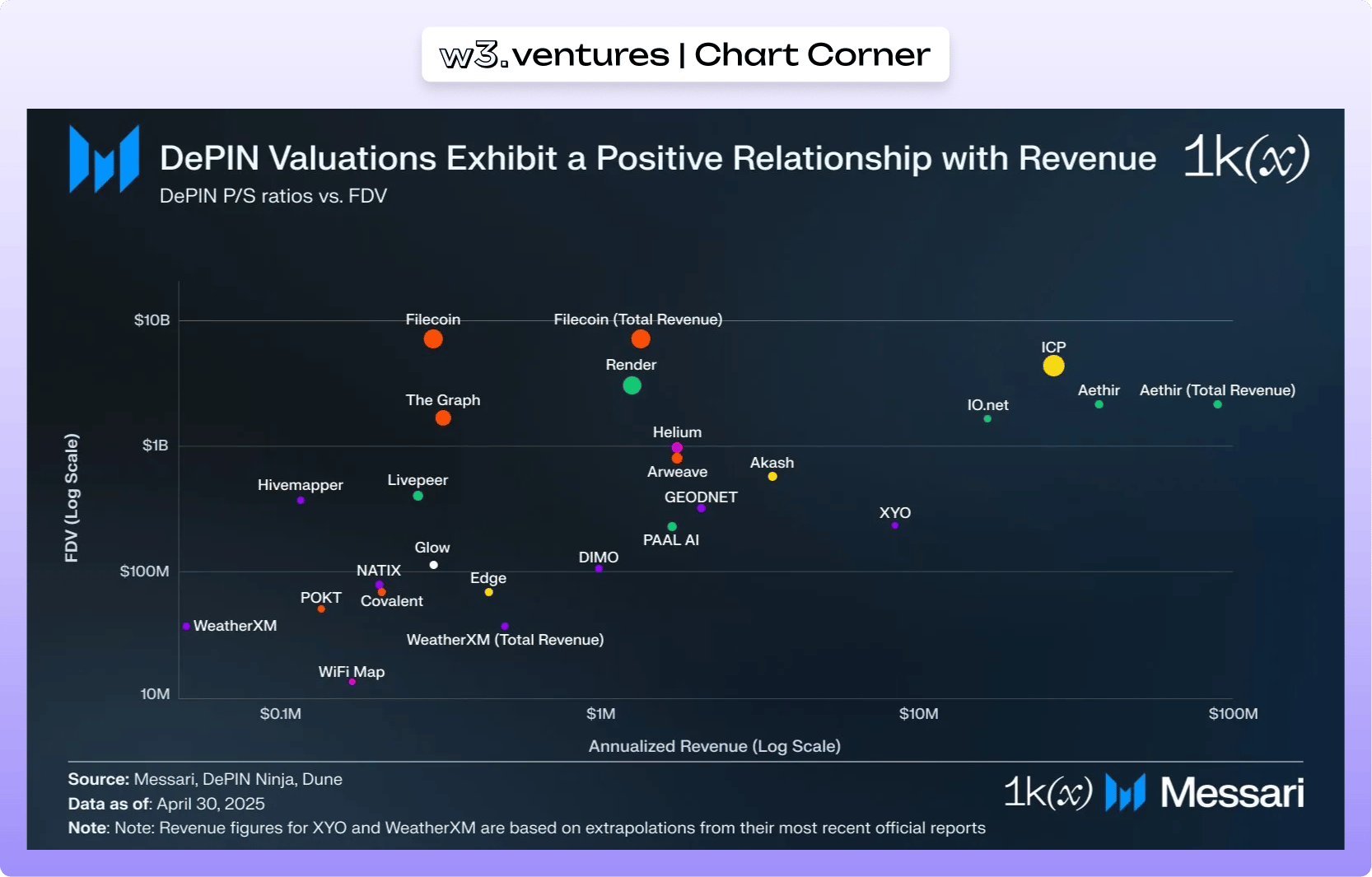

Henrik from w3.ventures provides insights into the DePIN sector, exploring projects with actual demand in a reflective analysis.

Tom from w3.labs offers an overview of the current state of institutional staking and its regulatory history.

Bitcoin has broken out—and now the big question is, what comes next?

If you've been following us for a while, you know we’ve been watching two possible paths this market could take in the short term:

On one hand, a strong breakout driven by momentum and macro tailwinds. On the other, a failed push higher that would leave Bitcoin ranging all summer, dragging altcoins down with it. There were good reasons to believe in either outcome.

The reasons for the bullish setup were compelling: Geopolitical uncertainty had cooled off, the Fed was hinting at a July rate cut, the dollar was weakening (which historically benefits crypto), and BTC dominance was peaking, possibly setting the stage for an altcoin rotation. Even the infamous “altcoin season” indicator hit its lowest point in a year, which is exactly where things tend to shift.

But there were cracks too. Equities had already ripped higher, Bitcoin had repeatedly failed at the 108–112k range, and summer’s weak seasonality loomed. Throw in unresolved tariff debates and the possibility of the Fed dragging its feet until September, and it made sense to be cautious.

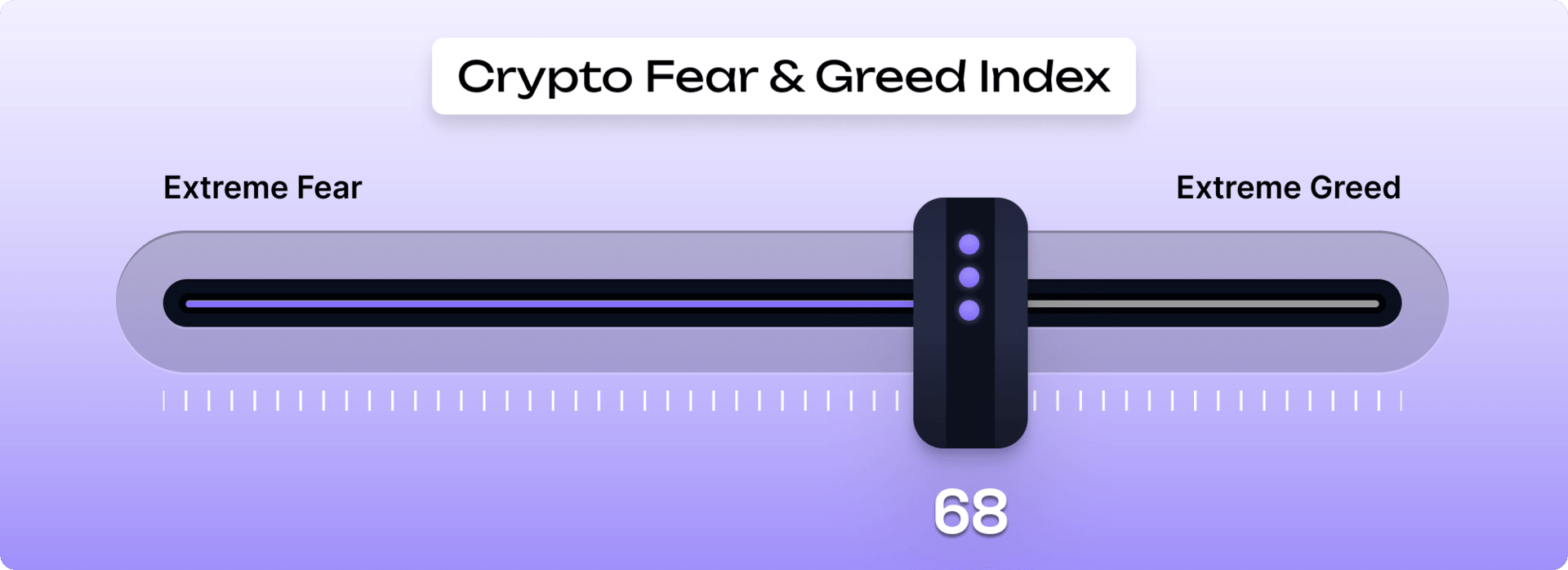

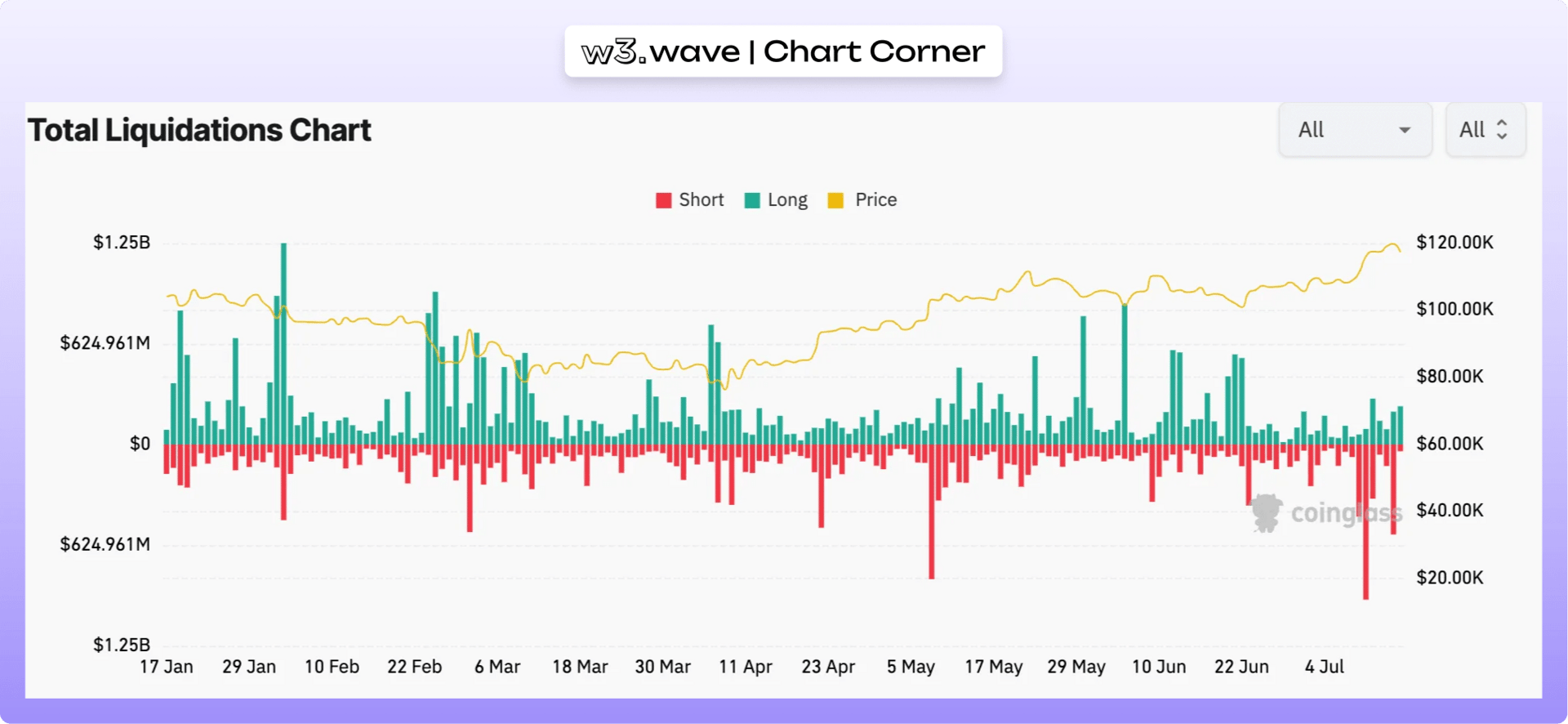

Now? We’ve seen a convincing breakout. Bitcoin surged past resistance with real momentum.

So, where do we go from here? For this rally to hold, we need to see trend continuation. Historically, strong BTC breakouts don’t like to stall - they accelerate. Choppy consolidation would be a red flag.

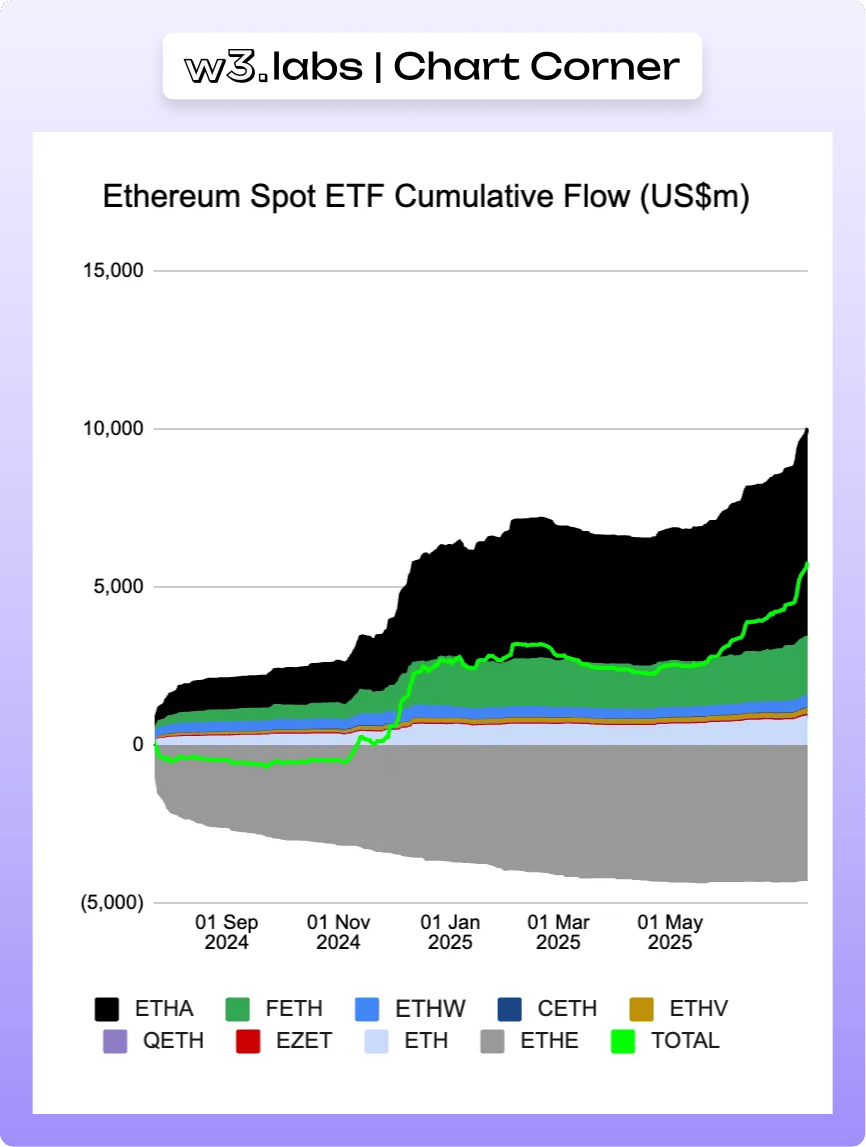

We're also watching volume. A lot of this recent move was driven by perp volume and short squeezes, where leveraged traders pushing the price higher. That’s fine for ignition, but it’s not what sustains a trend. We’ll be looking closely at spot buying, ETF inflows, and futures OI for clues on real demand.

And then there’s “alt season”. Once BTC cools off, we’ll want to see capital rotate. A drop in dominance would tell us that investors are reaching out on the risk curve, which is always a healthy sign in a sustained bull move.

If we get these ingredients, momentum, volume and rotation, then yes, we think we could be in for a very fun few weeks before any real corrective pressure builds again.

Are equities becoming the new altcoins?

Something interesting has been happening in the background while everyone’s been watching charts. Investors are piling into crypto-aligned public companies - stocks that offer exposure to digital assets, without touching a token.

Inspired by Michael Saylor and MicroStrategy, we’re seeing a wave of what we’d call “crypto treasury firms.” These are companies that raise capital and allocate it directly into BTC or ETH, essentially turning their equity into a vehicle for crypto exposure.

Metaplanet, a Japanese firm that used to run budget hotels, has completely reinvented itself. It now holds billions in Bitcoin, and its stock has delivered over 1,500% returns in the past year. Bitmine, a little-known U.S. firm, announced a $250 million raise to buy ETH - and its stock jumped 900% the next day. Circle’s IPO in June was another strong signal. Its stock rallied from $30 to $250 in just a few days.

These moves are catching investor attention, and for good reason. They feel like altcoin-level upside but in the form of a listed equity.

Which brings us to the punchline: are crypto equities becoming the new altcoins?

We think there’s truth to that. Some of the capital that would’ve previously gone into altcoins is now flowing into public companies with digital asset exposure. They offer similar narratives, similar asymmetry, but with broader access and less on-chain friction. In that sense, they’re not just a complement to altcoins. They’re competition.

Something to watch closely in the coming months.

DePIN: Where Web3 meets the real world

The infrastructure revolution is here, and it's being built by the people, for the people.

What is DePin?

Imagine if your spare GPU could earn you money by helping render the next Pixar movie. Or if your unused internet bandwidth could contribute to training the next breakthrough AI model while you sleep. That's the promise of Decentralized Physical Infrastructure Networks (DePIN) which turns everyday devices into network participants and income-generating assets that collectively build the infrastructure of tomorrow.

Instead of massive corporations owning and controlling networks, thousands of individuals contribute their devices, which range from wireless hotspots to graphics cards to storage drives, and earn rewards for providing real utility. It's Airbnb meets AWS, but built on blockchain rails with transparent, programmable incentives.

What's actually working in DePin: Real revenue, real users

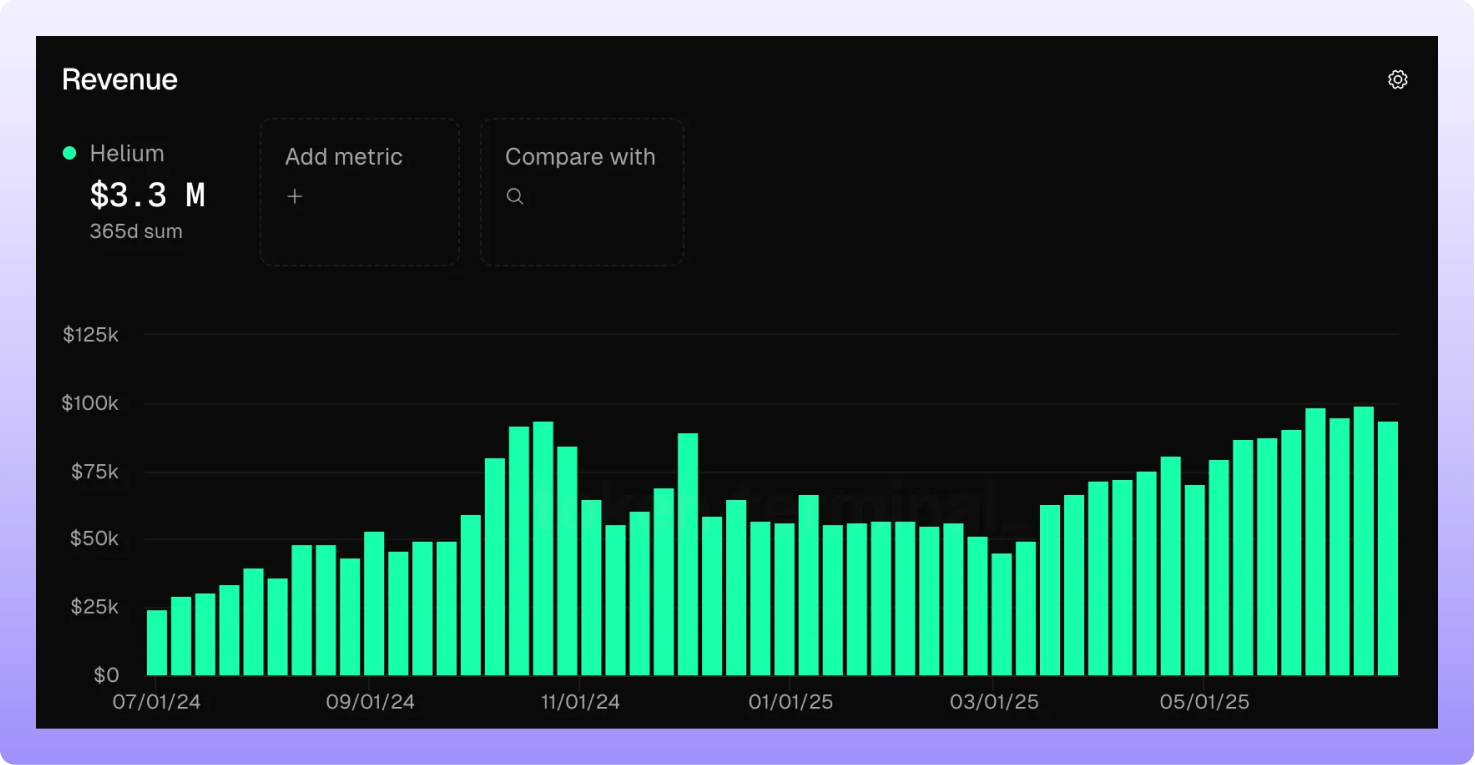

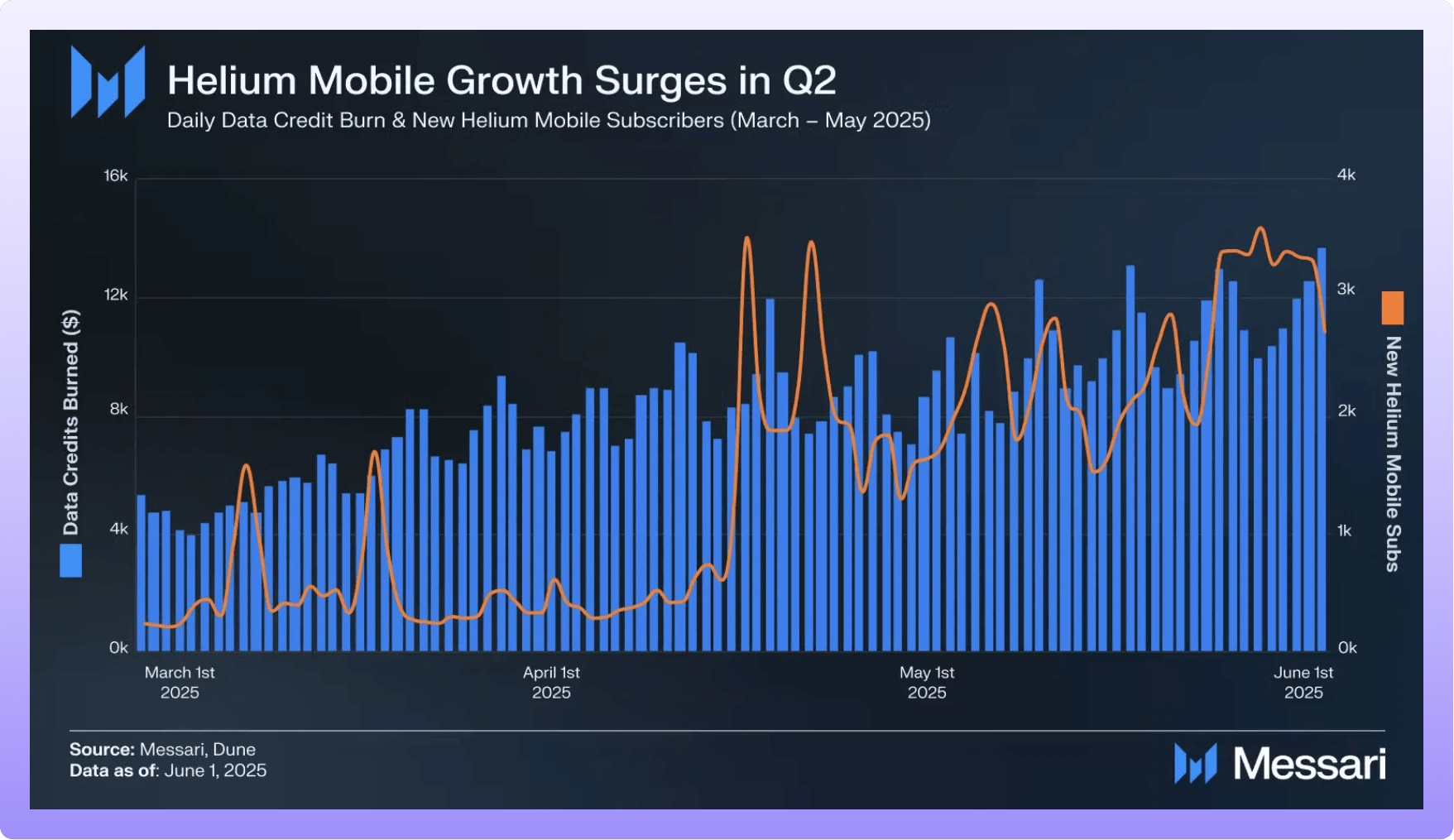

Helium: The wireless pioneer that delivered

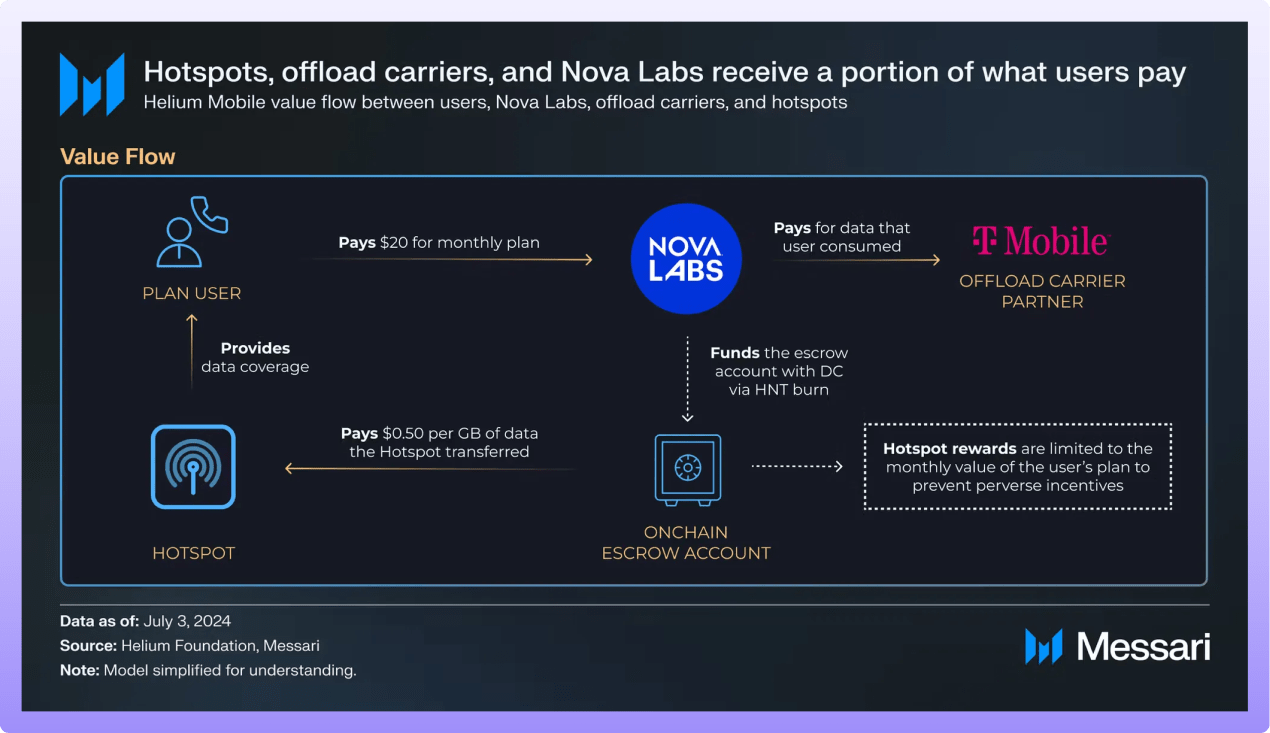

Helium mobile is a mobile phone service that runs on both traditional cell networks (via T-Mobile, in the U.S.) and the decentralized Helium 5G network. This network is provided by individuals who are hosting hotspots and in turn are getting rewarded in the currency of Helium (HNT). When your phone can connect to a Helium hotspot, it does. If it can’t, it falls back on T-Mobile’s national coverage.

Helium has become DePIN's first major success story, with over 129,000 mobile subscribers using its $30 unlimited plan—well below the U.S. average of $144 per month. The network has:

450K people accessing wireless internet through the decentralized network

Coverage across 77,000 towns and cities in 192 countries

What makes Helium compelling isn't just the scale; it's the economics:

Whenever someone uses Helium Mobile or connects an IoT device to the network, HNT is burned. This creates a deflationary dynamic: The more the network is used, the more HNT is burned. In theory, a reduced supply should increase the price. Since HNT is also the currency used to pay hotspot providers, all network participants holding HNT should be rewarded when the protocol is in demand and growing.

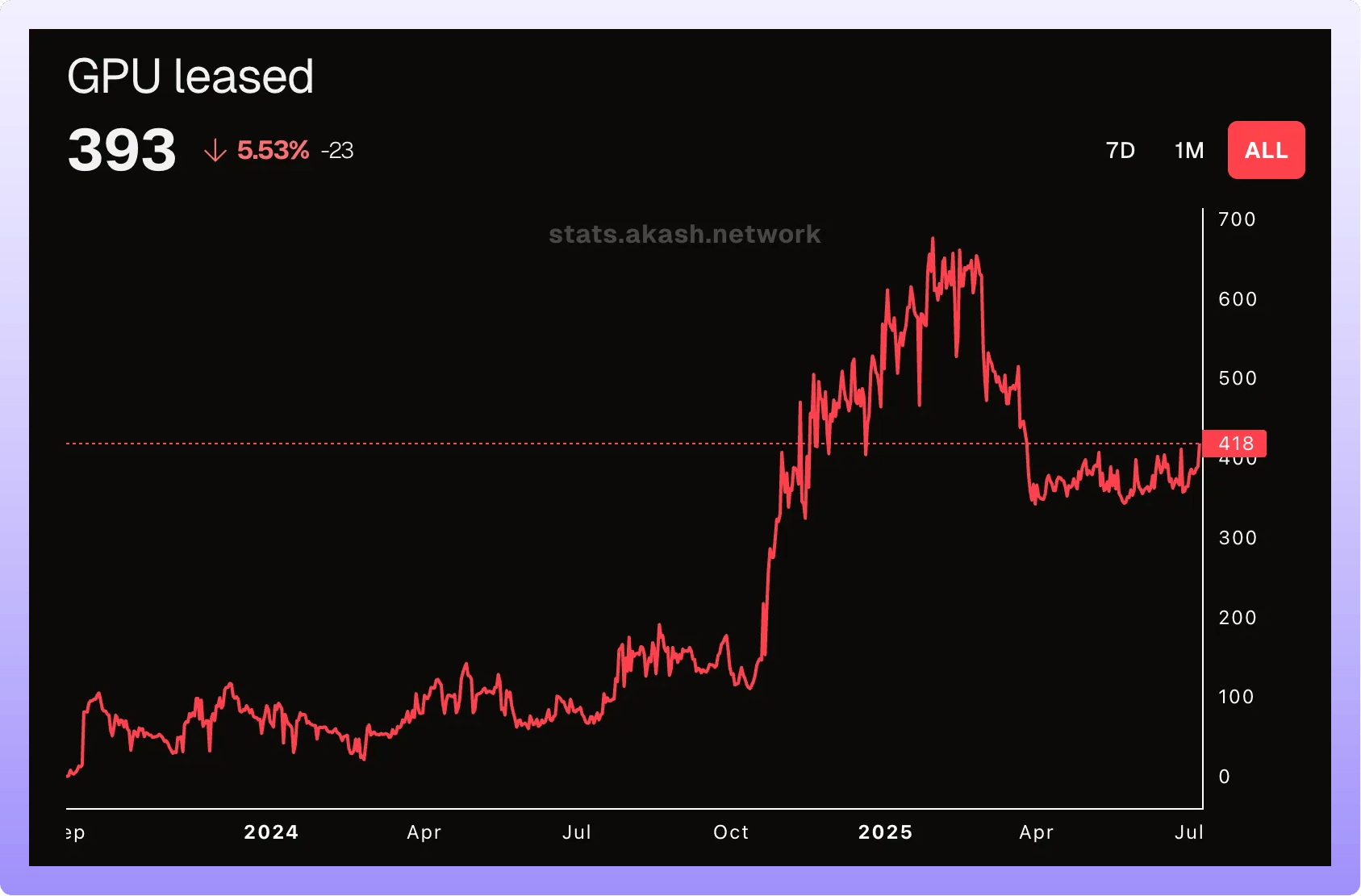

Akash: The AI compute marketplace scaling fast

Akash Network is solving the AI compute shortage by creating a decentralized marketplace where anyone can lease their spare GPU power to developers and companies training AI models. Instead of waiting months for cloud provider capacity or paying premium prices, AI developers can access distributed compute resources at up to 85% lower costs than traditional cloud providers.

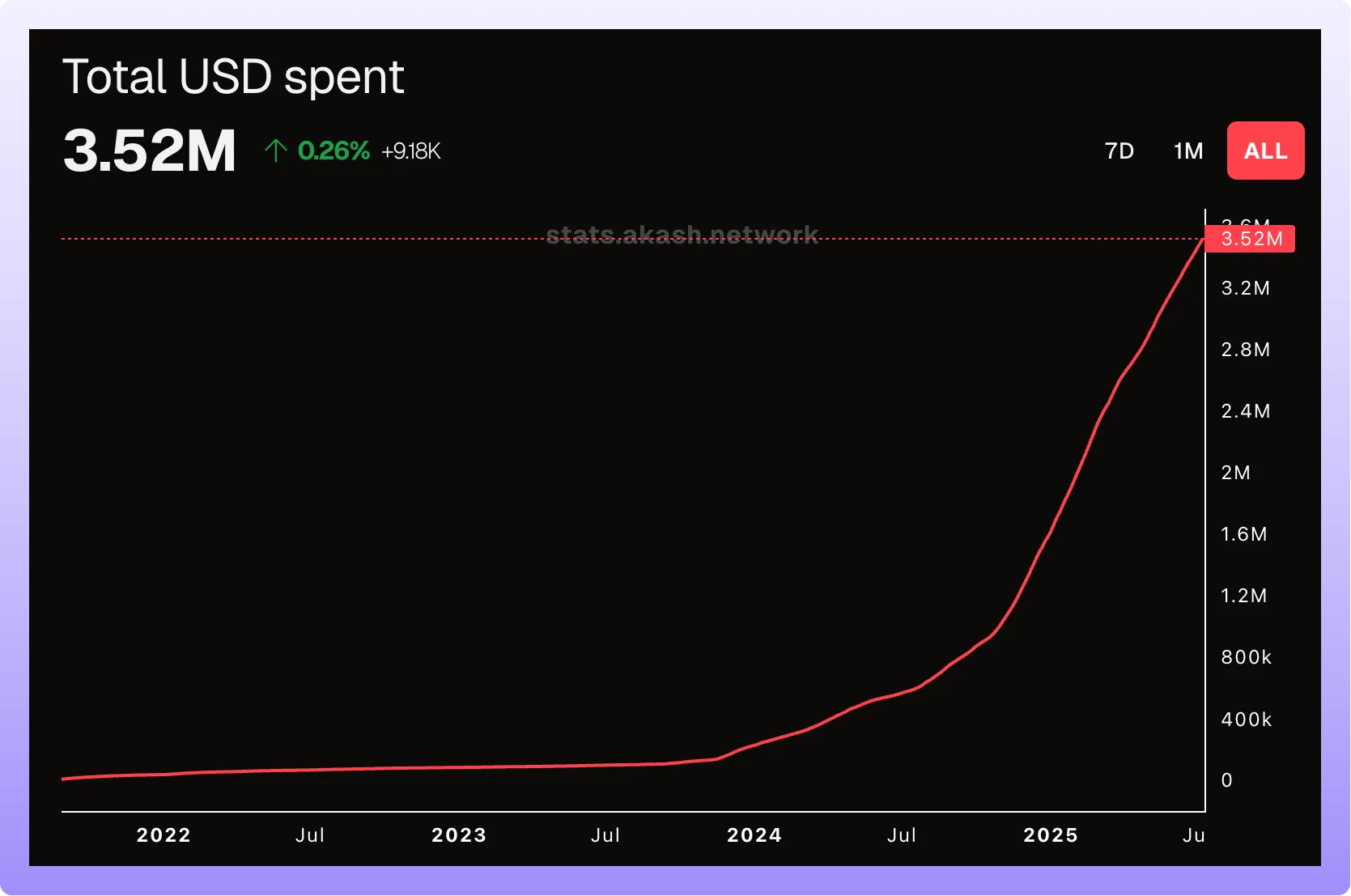

Akash Network has grown from less than 200 GPU leases before November 2024 to over 600 in January 2025, including 393 NVIDIA H100s. The platform generated $4.6 million in annualized network fee revenue by January 2025 and real customers are using Akash GPUs: brev.dev (acquired by Nvidia), Venice.ai, ElizaOS (formerly ai16z), and UT Austin. GPU utilization exceeded 79% with daily network revenue hitting a record $9K.

GEODNET: Precision Positioning for the Autonomous Future

GEODNET (Global Earth Observation Decentralized Network) is solving the precision positioning problem that's holding back the robotics and autonomous vehicle revolution. While regular GPS is accurate to within several meters, GEODNET's Real-Time Kinematic (RTK) network delivers centimeter-level accuracy, which is a 100x improvement that's essential for everything from robotic lawn mowers to autonomous tractors to construction equipment. Traditional RTK networks are expensive, centralized, and have limited coverage, but GEODNET crowdsources this infrastructure through thousands of individual station operators.

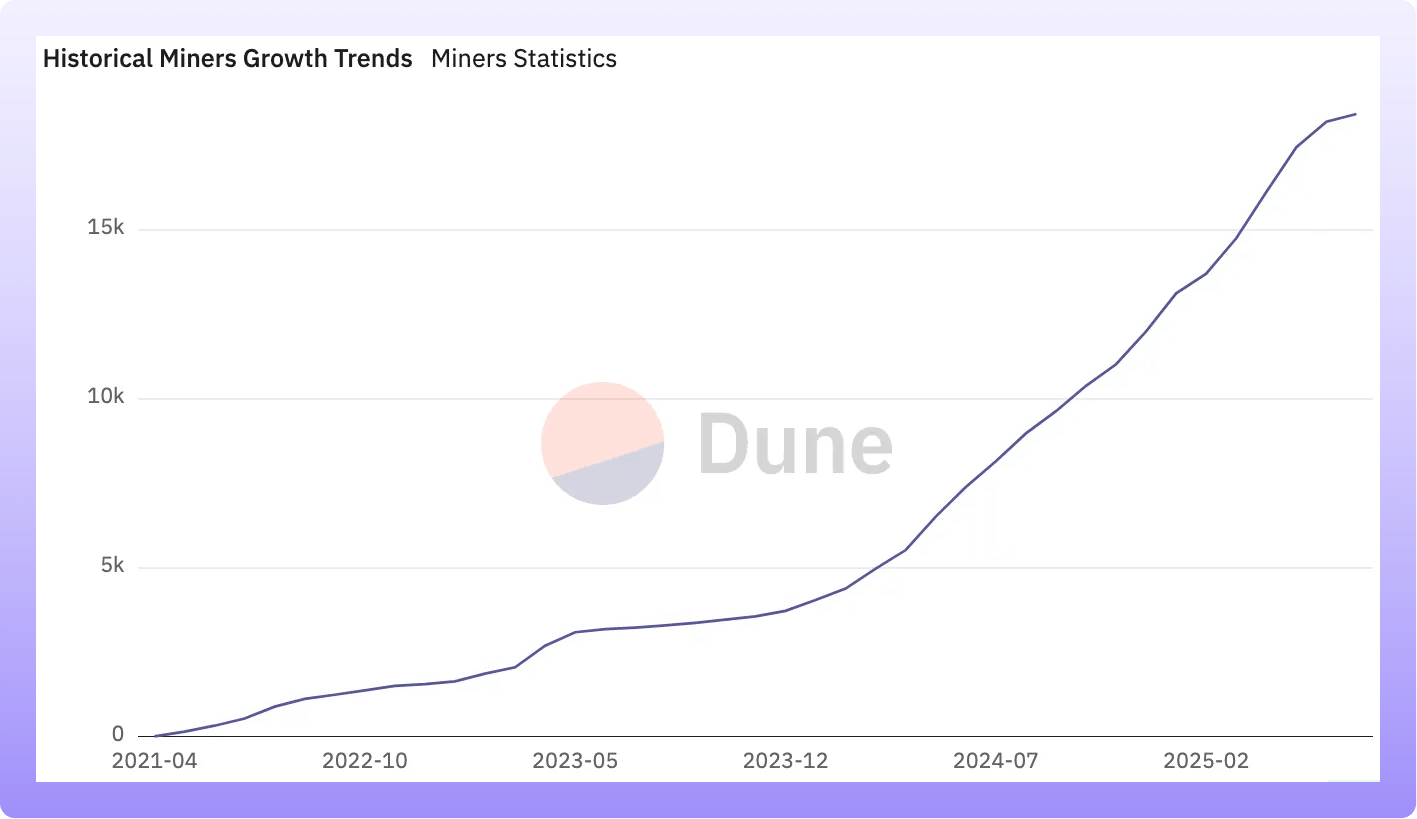

GEODNET has become the world's largest RTK network, with over 18,000 active satellite miners across 145 countries and 4,000 cities. The network expanded by 219% year-over-year in 2024, surpassing centralized competitors like Trimble in global coverage.

Real customers are already using GEODNET's positioning data: DroneDeploy for mapping, Septentrio for GNSS (Global Navigation Satellite System) receivers, Burro for agricultural robotics, and Bad Elf for precision navigation devices. The network generates revenue by selling RTK correction data to enterprises, with 80% of data revenue used to buy back and burn GEOD tokens.

Why Web3? Why now?

Traditional infrastructure faces three critical problems that DePIN solves:

1. Capital efficiency crisis Building physical infrastructure requires massive upfront capital that creates natural monopolies. DePIN distributes this cost across thousands of participants and therefore lowering barriers to entry and participate.

2. Misaligned incentives Traditional providers extract maximum value from users while minimizing service quality. DePIN aligns incentives between all actors—resource suppliers and consumers.

3. Innovation stagnation Monopolistic infrastructure providers have little incentive to innovate. DePIN creates permissionless networks where anyone can contribute improvements and earn rewards.

What's next: The categories to watch

Data and scraping for AI training

While tech giants like Google and Meta have privileged access to vast datasets through their platforms, smaller AI labs struggle to gather the diverse, real-time data needed to train competitive models. Grass democratizes this process by rewarding users for sharing their unused internet bandwidth to scrape publicly available web data.

AI infrastructure (48% of DePIN market cap)

Beyond compute and data, we're seeing emergence of decentralized model training. Prime Intellect successfully trained a 10 billion parameter language model across five countries using their DiLoCo framework.

Energy networks

Virtual Power Plants (VPPs) combining distributed energy resources like solar panels and EV chargers are creating more resilient grids. Projects like Daylight or Combinder enable anyone with solar panels to sell energy and grid data back to utilities.

Transportation & mapping

Real-time mapping like Hivemapper/beemaps using dashcams and drones provides more accurate, frequently updated data than traditional approaches. These crowdsourced databases update continuously from diverse, decentralized sources.

Are DePINs ideal Web3 applications?

While DePINs seem like a perfect match for crypto and an innovative way to build and decentralize capital-intensive physical infrastructure, they are far from perfect. There is no one-size-fits-all solution. Often, revenues seem great as long as you don't take into account the incentives that the protocol is paying out. Those incentives can be appropriate during growth phases, but at some point, they need to phase out, and real revenues paid by customers need to take over. Additionally, some projects rely solely on a buyback and burn mechanism to distribute value. This mechanism has been criticized for 1) rewarding token holders who don't play an active role in the protocol and 2) only having a positive impact on the token price if the token is in high demand. In short, reducing the quantity of something worthless doesn't make it valuable.

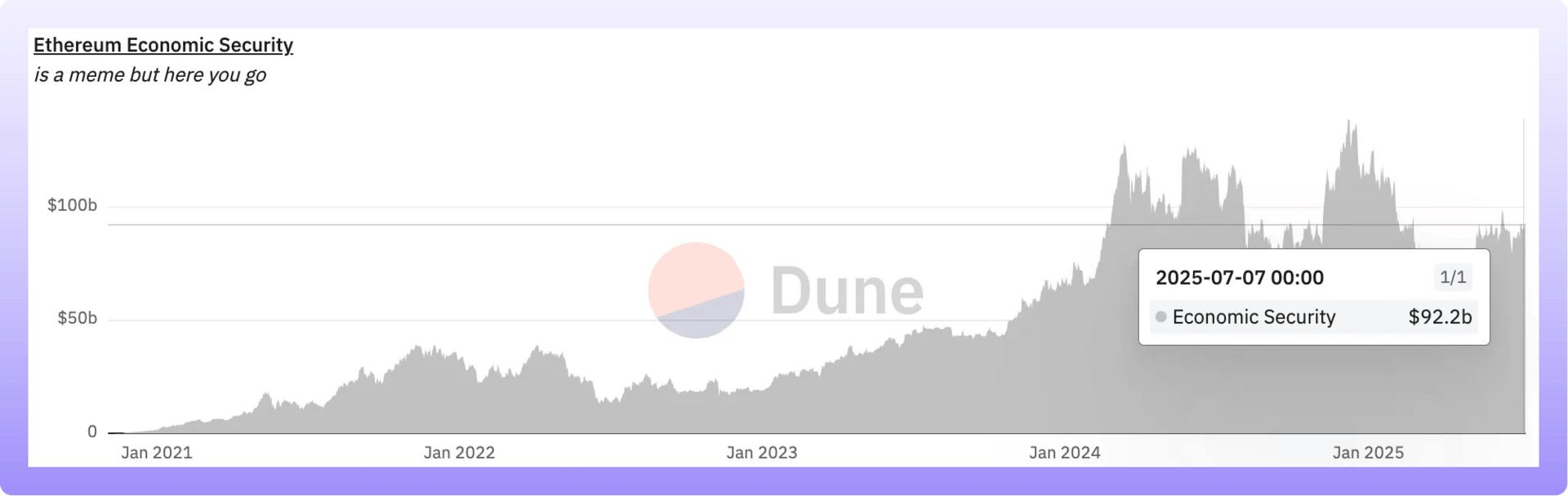

The state of institutional staking

The institutional staking landscape has reached an inflection point in 2025, driven by unprecedented regulatory clarity and explosive growth. With over $193 billion in digital assets currently staked across major proof-of-stake networks, institutional participation is accelerating rapidly. As the graph below shows, Ethereum alone reached a total value staked of $92 billion USD.

The SEC's May 29, 2025, guidance that certain staking activities do not violate securities law marked a turning point for U.S. institutions, following years of restrictive policies under Gary Gensler's leadership.

Meanwhile, European markets continue to lead with established staking ETPs. In contrast, US investors have missed out on over $61 million in ETH staking rewards from established ETFs without staking. Financial advisors increasingly recommend crypto allocations of 1-5%, though Ric Edelman of Edelman Financial Engines is an outlier, recommending up to 40%. The next logical step could be significant funds flowing into staking strategies.

Regulatory timeline: How crypto staking became accessible for institutions

November 20, 2018 - Europe's crypto ETP pioneer

21Shares launches the first cryptocurrency exchange-traded product (ETP) on the Swiss stock exchange, establishing the foundation for regulated crypto investment products in Europe. Their physically-backed Bitcoin ETP (ABTC) demonstrates institutional demand for regulated crypto exposure.

October 1st, 2021 - Germany sets transfer rules

Germany introduces the Kryptowertetransferverordnung (KryptoWTransferV) and with that new rules requiring enhanced due diligence for crypto transfers, laying groundwork for institutional compliance.

Mary 20, 2022 - German tax clarity

Germany's Finance Ministry (BMF) releases updated guidance on crypto tax treatment, providing clearer rules for staking rewards and institutional crypto activities.

September 20, 2022 - First Ethereum staking ETP

21Shares launches the first Ethereum Staking ETP in Europe, allowing investors to gain exposure to both Ethereum's price and staking rewards without directly holding the cryptocurrency.

December 2023 - Switzerland leads the way

Switzerland's financial regulator (FINMA) says "staking services don't need banking licenses" which gives the green light for companies to offer non-custodial staking without the same capital requirements as custody providers.

January 30, 2024 - Europe's MiCAR goes live

The EU's Markets in Crypto-Assets (MiCAR) regulation officially takes effect. ESMA clarifies that staking services require authorization only when intermediaries hold crypto-assets for clients, distinguishing between technical staking and staking-as-a-service.

April 22, 2025 - SEC leadership change

Paul Atkins, a crypto-friendly former SEC commissioner, is sworn in to replace Gary Gensler as SEC Chair, signaling a more favorable regulatory approach toward digital assets.

May 29, 2025 - America's breakthrough moment

The SEC finally says "certain staking activities are NOT securities". This means companies can offer staking services without worrying about breaking securities laws.

July 2, 2025 - First US staking ETF launches

Just one month after the SEC guidance, the first American staking ETF starts trading (REX-Osprey Solana ETF). This confirms the regulatory upturn and enables the USA to catch up with Europe regulation.

Institutional staking options

Institutions today have three primary ways to access staking rewards, each with distinct trade-offs:

ETFs/ETPs

How it works: Buy shares in funds that hold and stake crypto on your behalf

Pros: Familiar investment structure, regulatory compliance, no technical complexity

Cons: Utilization (due to lock-up periods and liquidity ETPs typically only stake 60-90% of their assets), staking fees to underlying staking provider (10%-20%), management fees (typically 0.5-2%), no direct control over staking decisions

Best for: Traditional investors seeking crypto exposure through established channels

Examples: REX-Osprey Solana ETF (US), 21Shares Ethereum Staking ETP (Europe)

Custodial Staking

How it works: Third-party providers hold your crypto and manage staking operations themselves or through a partnership with a staking provider

Pros: Professional management, insurance coverage, compliance reporting

Cons: Counterparty risk, staking fees (10-20%), custody fees (0.5-2% annually), less control

Best for: Institutions prioritizing security and compliance over cost optimization

Examples: Coinbase Institutional, Anchorage Digital, major crypto custodians

Non-Custodial Staking

How it works: You retain ownership of assets while delegating validation rights

Pros: No counterparty risk, lower fees, full asset control

Cons: Technical complexity of handling wallets/keys

Best for: Crypto-native institutions with technical capabilities or traditional institutions willing to go through on-boarding

Examples: Direct validator operations, delegation to specialized providers

At w3.labs we are actively working on making non-custodial staking more accessible for institutions and everyone by providing compliant staking solutions for digital assets. We solve the complex regulatory and tax challenges that arise when staking digital assets. Unlike other solutions that either lack regulatory compliance or technical sophistication, our German-based infrastructure is designed specifically for the European regulatory landscape.

Highlights from w3.group

We’re still overwhelmed and are processing everything that happened during Berlin Blockchain Week. So if you haven’t done so far, check out our aftermovie.

Berlin’s Home of Web3

In 3 years, w3.hub has become the go-to space for builders.

Hundreds of events, endless connections.

What we offer our community ↓

— w3.hub (@w3_hub)

2:08 PM • Jun 23, 2025