- Web3 Investor Briefing by w3.group

- Posts

- Web3 Investor Briefing | June 2025

Web3 Investor Briefing | June 2025

Every month we provide you with insightful deep-dives into the world of Web3 investing.

Welcome to this special edition of our investor briefing, featuring highlights from our AGM, which took place at the beginning of this month.

We invited our Limited Partners and investors to our home, the w3.hub, to share our progress in the different parts of the w3.group, and ended the evening with a delicious flying dinner.

In this episode, we will share with you all the insights that we presented to our LPs and investors during the AGM.

w3.fund Annual General Meeting

TL;DR

A macro and crypto market analysis, insights into the w3.wave operations, a fundamental deep dive, and reflections with Julius.

Valuable insights on the state of Web3 venture funding and our investment process by Henrik from w3.ventures, combined with reflections on what is currently working and what isn’t

Tom from w3.labs shared the history and need for our compliant staking solution combined with a live demo of our Ethereum staking platform.

Our investment framework: Fundamentals vs. narratives

Our investment approach balances two complementary lenses, enabling us to invest in both fundamentally sound projects — as well as more short-lived narratives:

Fundamentals-driven analysis focuses on technical utility, adoption metrics, and revenue generation. This approach targets long-term, sustainable growth trajectories and typically offers more stable returns with slower compounding. It's essential for evaluating the long-term viability of projects and protocols.

Narrative-driven analysis tracks sentiment, social media trends, and broader cultural/macro themes. This lens often drives short-term, hype-driven price action with higher upside potential but increased volatility. Understanding narratives is critical for timing market entries and exits effectively.

Current narrative opportunities:

AI × crypto

Decentralized compute, machine learning, and autonomous agents

Driven by ChatGPT/NVIDIA hype and pushback against centralized AI

Our view: High-growth, high-volatility narrative with emerging fundamentals—difficult to value precisely, keeping potential upside substantial

DeSci (decentralized science)

Open-source scientific research funding on-chain

Gaining interest from high-profile thinkers and addressing legacy funding gaps

Our view: Long-term, early-stage thesis with strong fundamentals that's attracting exceptional non-crypto talent

Beyond speculation: Crypto's tangible impact accelerates

The crypto ecosystem is rapidly evolving beyond speculative assets into infrastructure with meaningful real-world applications. Three key sectors are leading this transformation:

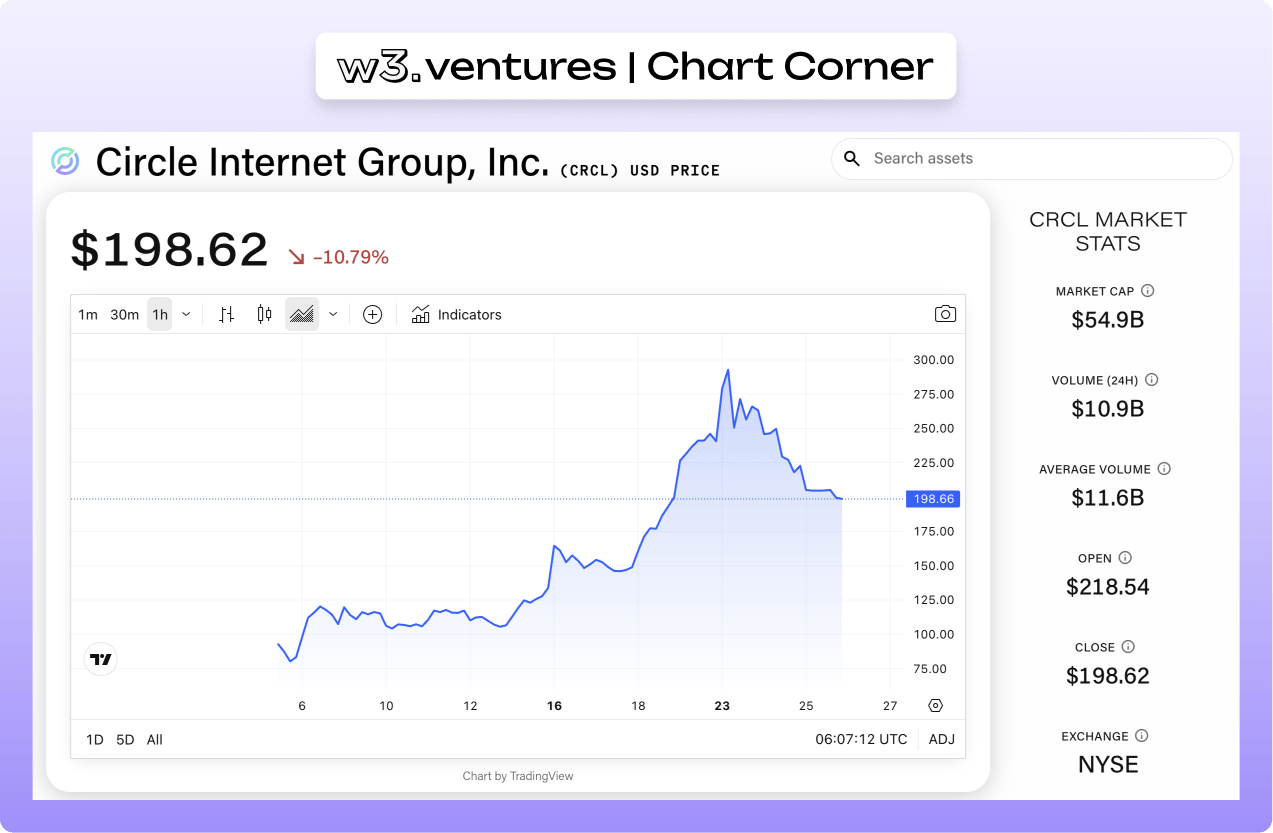

Stablecoins: The digital dollar revolution

The stablecoin market has grown to over $190B in market cap and continues expanding. These digital dollars enable fast, affordable payments globally and are seeing remarkable adoption in emerging markets across LATAM, Africa, and Southeast Asia. Real-world use cases have expanded beyond trading to include payroll, remittances, and yield strategies. Stripe's recent launch of stablecoin-funded accounts in over 100 countries demonstrates how mainstream financial services are integrating this technology.

DeFi: Financial services without gatekeepers

With $110B total value locked across protocols, DeFi provides permissionless access to lending, trading, and yield generation. Institutional adoption is accelerating, evidenced by BlackRock's BUIDL fund integration with Securitize. Traditional finance is increasingly embracing DeFi infrastructure, with Coinbase Base and BlackRock leading the way. Tokenized real-world assets (RWAs) are gaining significant traction, bridging traditional finance with blockchain efficiency.

DePIN: User-owned infrastructure networks

Decentralized Physical Infrastructure Networks have attracted over $1B in venture funding since 2023. These networks enable users to build and monetize physical infrastructure using blockchain incentives. Use cases are expanding across decentralized storage, telecommunications, and energy grids, with real-world applications emerging in IoT, smart cities, and AI compute. Helium Mobile's launch of the first free 5G phone plan demonstrates the consumer-facing utility these networks can provide.

Our investment approach: How w3.wave operates

In today's rapidly evolving crypto landscape, our investment strategy at w3.wave is built on three core principles that guide our decision-making and portfolio construction:

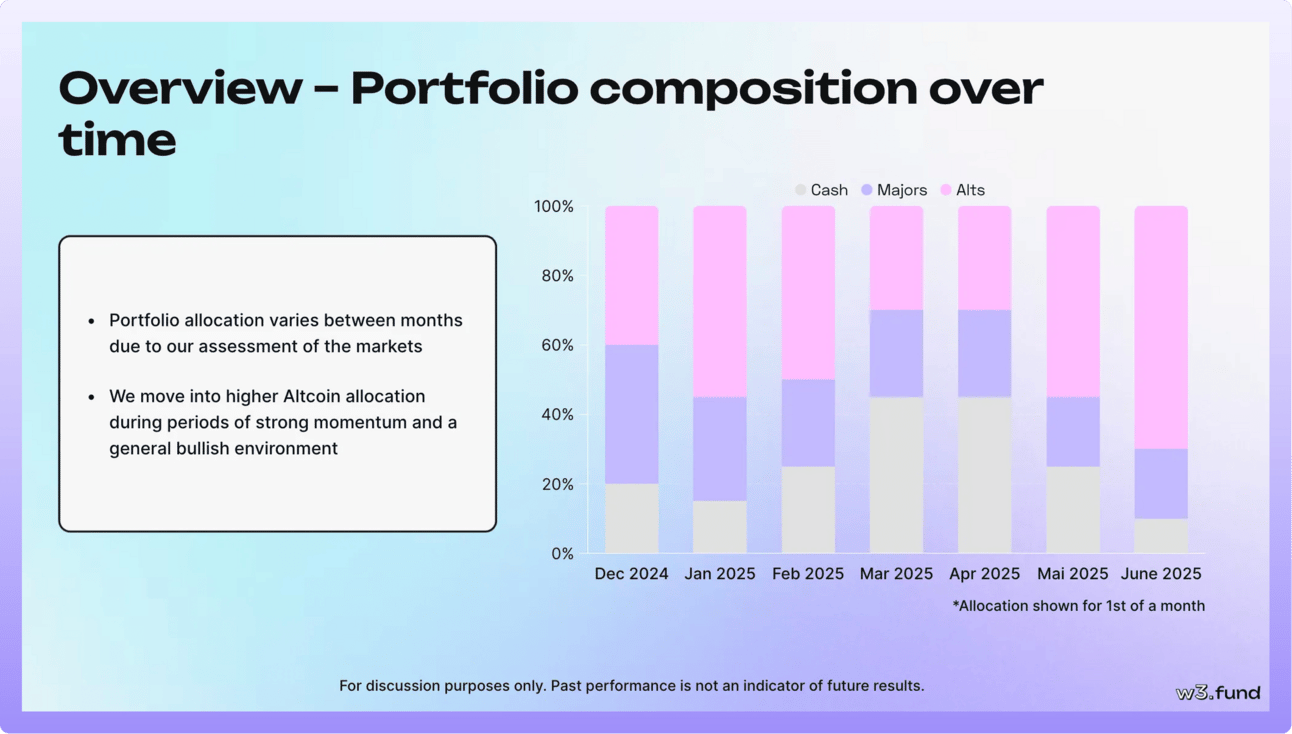

Flexibility with liquid tokens

We maintain a 100% discretionary and actively managed fund with a concentrated approach—typically holding just 8-10 tokens. This focused strategy allows us to develop deep conviction in each position and respond quickly to changing market conditions. We aim to generate venture-like returns while preserving liquidity and avoid the dilution that comes with over-diversification.

Unlike traditional venture funds locked into illiquid positions for years, our liquid portfolio enables us to adapt to the market's rapid evolution while still targeting high-growth opportunities.

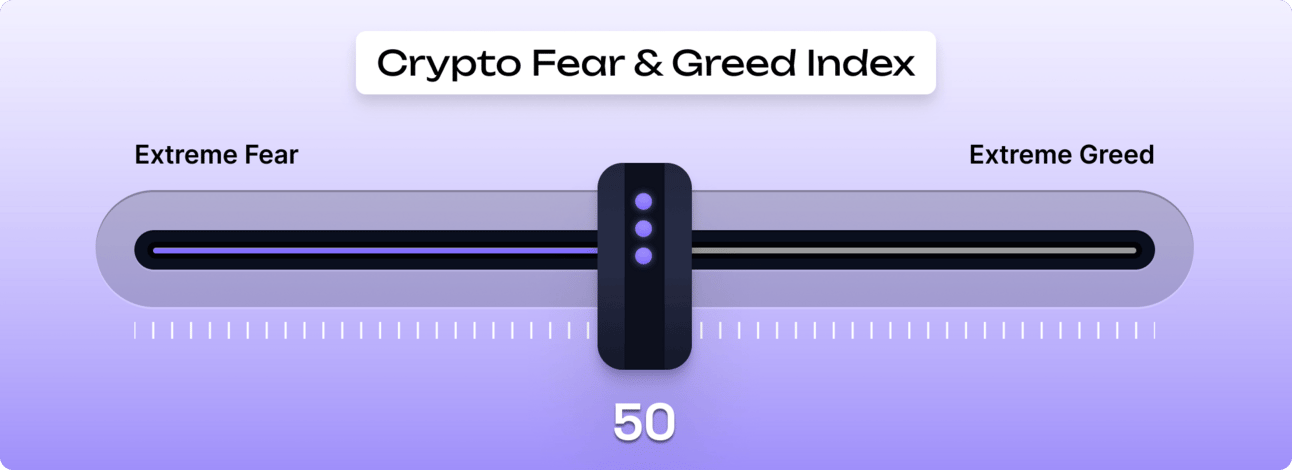

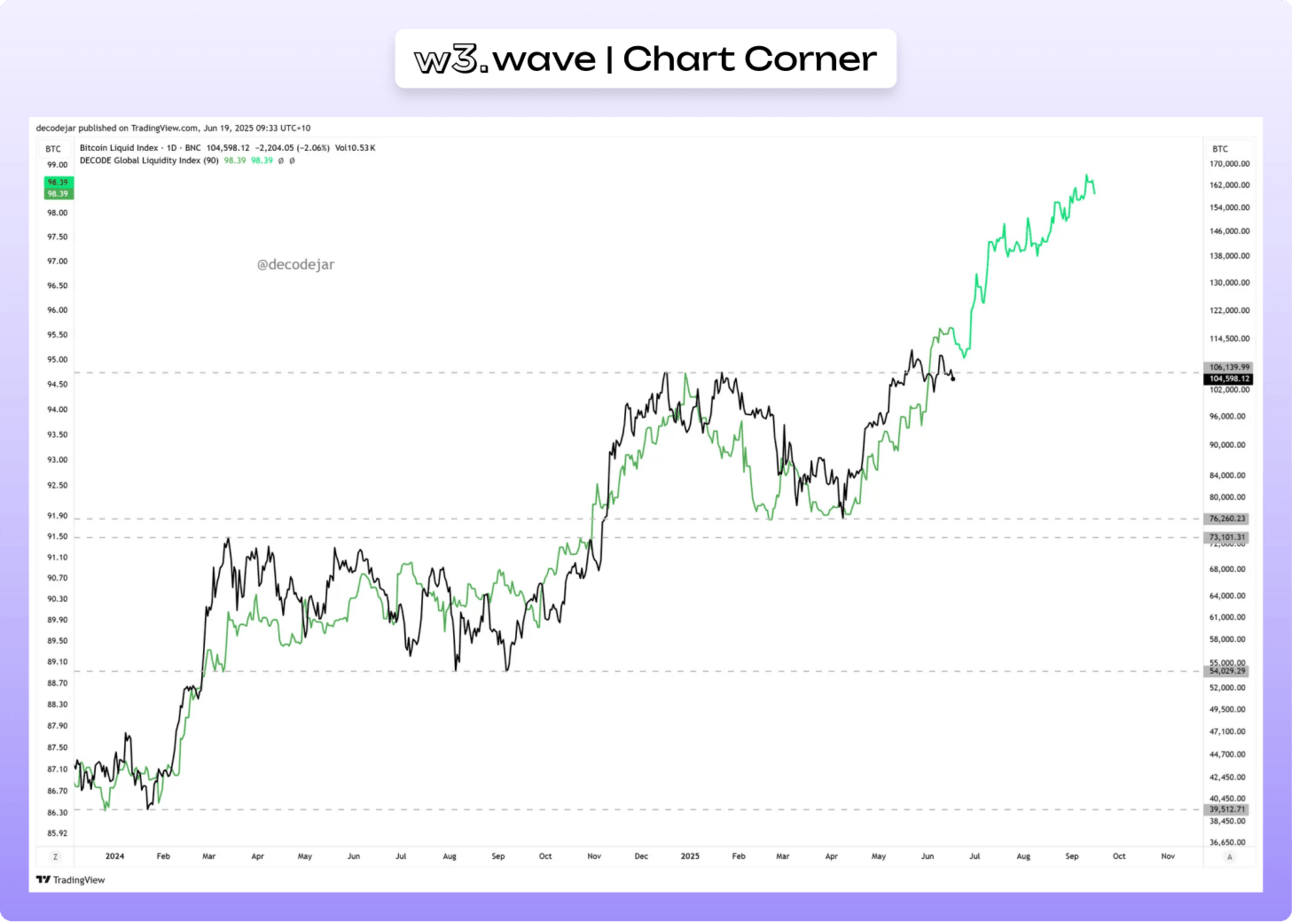

Adaptive at the core

The crypto market operates at the intersection of fundamentals and narratives—both matter for successful investing. Our dual-lens approach allows us to capitalize on fundamentally strong protocols with sustainable value creation while identifying and positioning for opportunistic, narrative-driven market trends. We generate alpha through active management while tracking underlying market beta and adjust positioning as narratives shift and fundamentals evolve.

This balanced perspective helps us navigate the unique dynamics of crypto markets, where sentiment can drive short-term price action while fundamentals determine long-term success.

Capital never sits idle

Our open-ended structure gives us the flexibility to deploy capital strategically across market cycles. We pursue outsized returns during bull markets through strategic position sizing and implement capital preservation and yield strategies during downturns. Our approach continuously compounds growth through active management while maintaining dry powder for opportunistic entries during market dislocations.

This cycle-aware approach helps us build sustainable, long-term returns while managing the volatility inherent in crypto markets.

Web3 venture funding landscape

The Web3 ecosystem is undergoing a profound transformation. The days of indiscriminate funding and speculative hype are over. Today's market demands substance, utility, and sustainable growth, which are qualities that have always been at the core of our investment philosophy at w3.ventures. This section explains why the market remains challenging.

Excessive funding rounds and market distortion

On one hand the era of "hype-driven capital" appears to be winding down, with funds looking more for traction and revenue compared to previous cycles. On the other hand major players like a16z and mega-funds are funding the available quality projects at high valuations as they have a lot of capital to deploy and there is a finite number of these ventures. While deal consolidation continues, we're seeing larger but more strategic checks being written, signaling a shift toward quality over quantity in investment decisions.

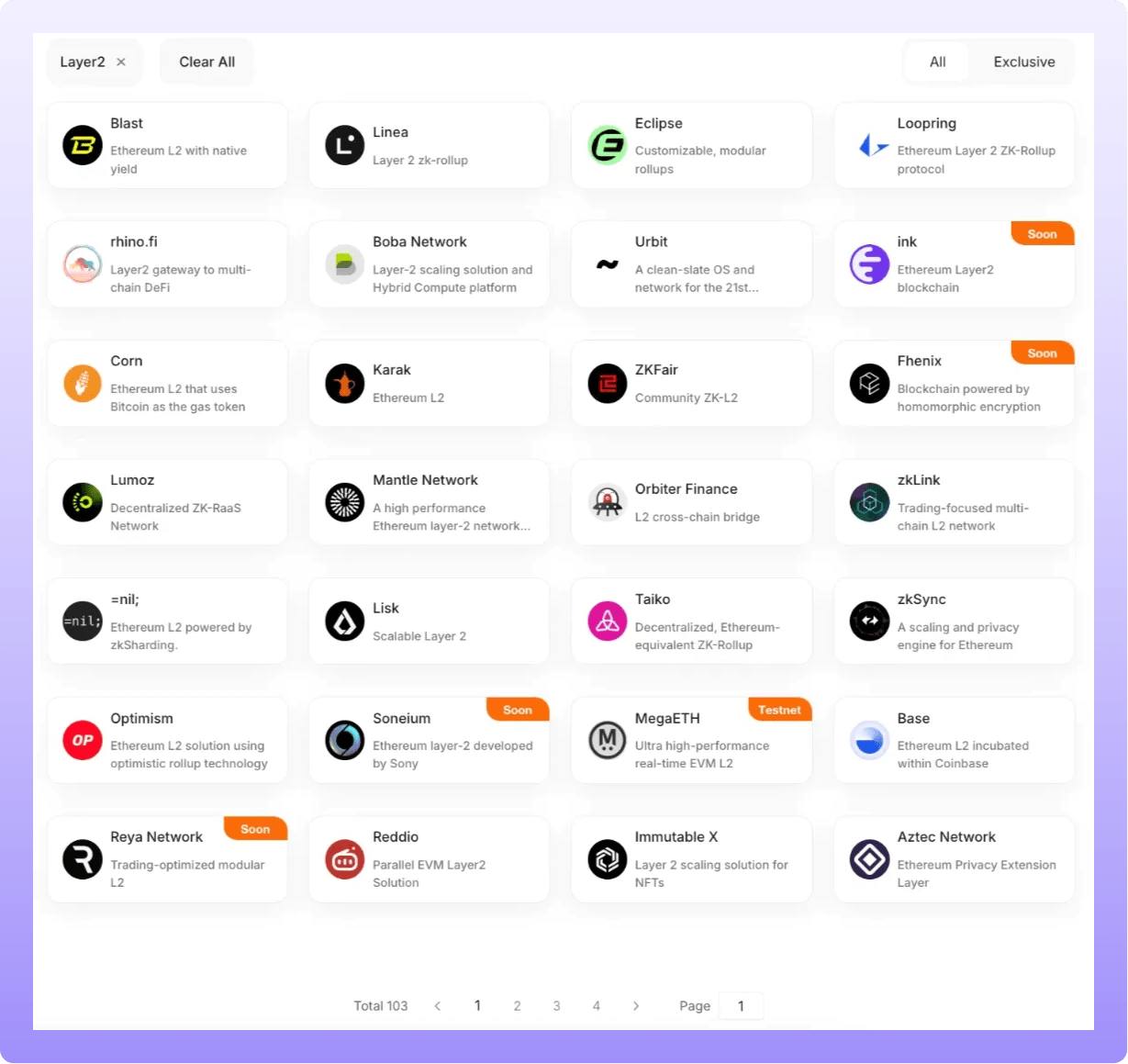

Infrastructure over-investment challenge

A critical imbalance has emerged in the Web3 funding ecosystem: Layer-2 solutions and rollups have attracted $2.6B in funding, while consumer applications remain comparatively underfunded. The graphic below shows four pages of 28 Layer 2 Blockchains on Ethereum alone. These are a testament to the fact that "too much capital is chasing the same infrastructure plays" , creating a saturated market where differentiation becomes increasingly difficult.

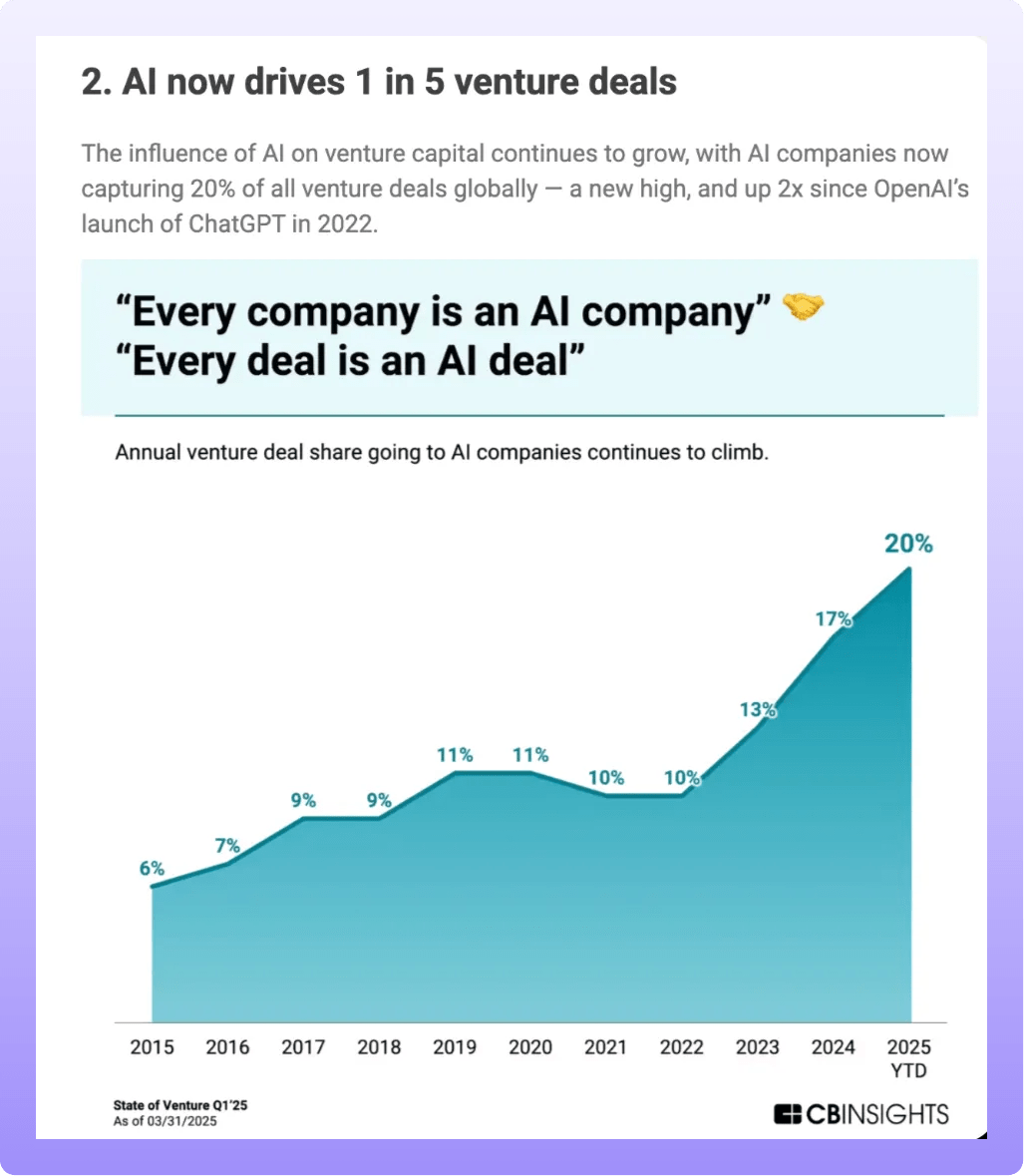

The AI x Web3 convergence: Leading the investment wave

AI companies are now capturing 20% of all venture deals globally, which is double the percentage since OpenAI launched ChatGPT in 2022. The market sentiment is clear: "Every company is an AI company" and "Every deal is an AI deal".

In Web3, the integration of AI has become the dominant funding trend, capturing approximately 26% of the total capital raised ($1.8 billion) from 2024 to 2025. This convergence is reshaping the competitive landscape and has significant implications for startups and VCs alike.

Non-AI applications in the Web3 space are "struggling with it" , facing heightened competition for funding and attention. This creates both challenges and opportunities for founders who must either integrate AI capabilities or find distinctive value propositions that don't rely on AI as their core differentiator.

The new investment thesis: Quality, traction, and utility

Although these factors make navigating the market challenging for us, we are happy that the investment criteria for Web3 ventures have fundamentally shifted, with a clear emphasis on: Revenue and traction as mandatory requirements.

Mostly gone are the days where speculative projects could secure funding based on concepts alone. The new dogma emphasizes that "revenue and traction are now mandatory", reflecting investors' heightened focus on sustainable business models and proven market demand. Also, we witnessed that Web3 venture investors are adopting a "quality over quantity approach", conducting more thorough due diligence and showing preference for teams with demonstrated execution capabilities rather than merely promising ideas.

What's working

The Web3 landscape is experiencing a shift in 2025, with clear winners emerging as the market matures beyond speculative hype. Five key sectors are demonstrating substantial growth and institutional adoption:

1. Stablecoins

Stablecoins have established themselves at the center of the crypto economy, reaching an impressive $200B+ market cap. They are the first Web3 use case with very clear product-market fit. Major financial players like Stripe are aggressively pushing into the stablecoin space, signaling mainstream integration. Furthermore, companies like SpaceX use them for their infrastructure, and Uber plans to do so as well.

2. RWA & DePIN

Real-World Assets (RWA) tokenization and Decentralized Physical Infrastructure Networks (DePIN) represent two of the fastest-growing sectors, with 150% funding growth year-over-year and over $2B invested. This trend reflects the market's shift toward practical applications that bridge blockchain technology with tangible real-world value and utility.

3. AI x web3

As mentioned above, this convergence creates new opportunities for autonomous agents and decentralized intelligence systems that leverage the strengths of both technological paradigms. Since this is the most popular narrative of this cycle, we must be careful to find fundamentally sound teams.

4. Social graphs

Social applications built on blockchain are experiencing remarkable adoption, with 518% user growth in SocialFi platforms. Notably, Asia is leading this adoption wave, suggesting a geographic shift in where Web3 innovation is finding its most receptive audiences.

5. Consumer apps

Consumer applications with blockchain-core infrastructure are gaining traction, particularly in gaming. Studios are increasingly incorporating blockchain elements that provide actual utility rather than speculative features.

What's not working anymore

As the market matures, several previously hyped areas are experiencing significant slowdowns:

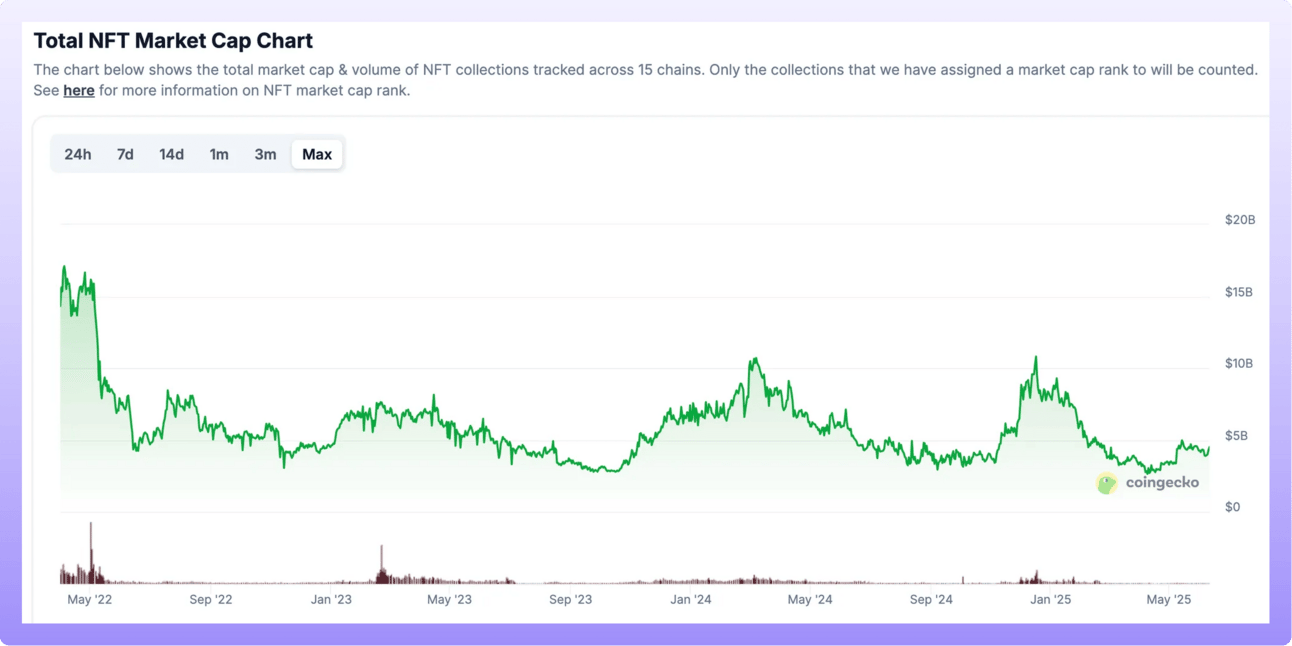

1. NFTs

The NFT market has suffered a dramatic 90% volume decline since 2022. The speculative bubble that drove astronomical valuations for digital collectibles has effectively burst, with pure speculation-driven projects largely abandoned. The remaining NFT activity is focused on utility and integration with broader ecosystems.

2. Infrastructure

As mentioned above, the infrastructure sector is experiencing a necessary correction after years of overinvestment. Venture capitalists are finally moving on from funding redundant Layer-1 and Layer-2 solutions, recognizing that the market cannot sustain the current proliferation of competing protocols with similar value propositions.

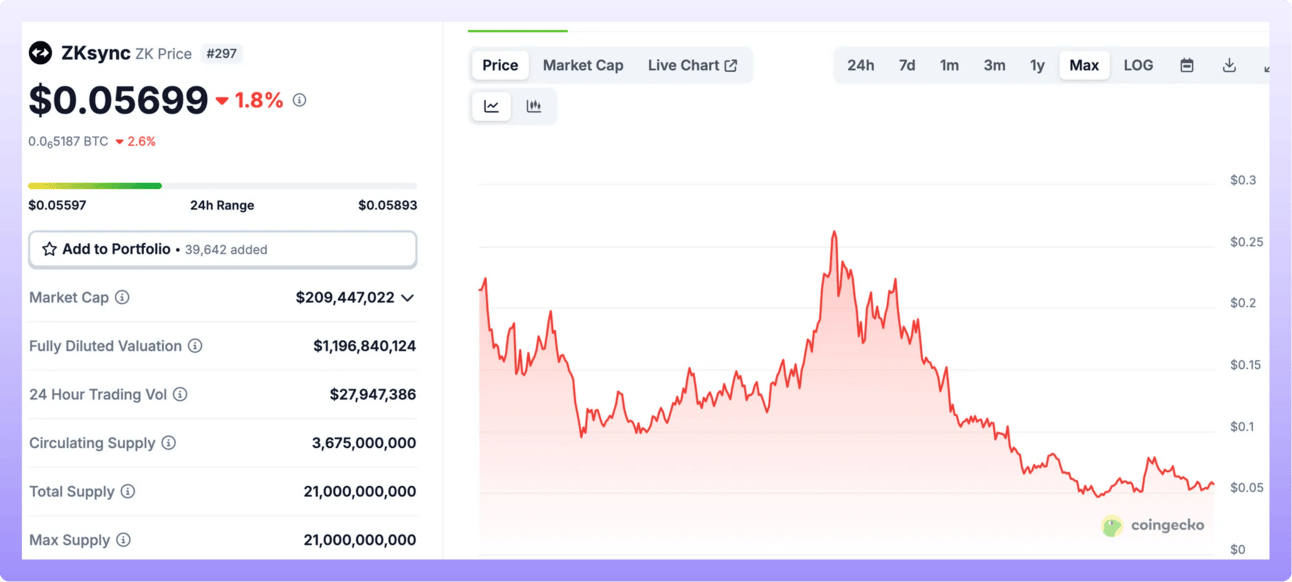

3. Token launches with high Fully Diluted Value

Traditional token launch mechanisms, particularly airdrops, are consistently underperforming. High fully diluted value (FDV) models are failing to deliver sustainable value, as investors have become more sophisticated in evaluating tokenomics and are increasingly skeptical of projects with inflated valuations but limited utility.

Stablecoin panel

At our recent AGM, w3.fund founding partner Feliks Eyser moderated an insightful panel featuring Tamar Menteshashvili, (Head of Stablecoin at Solana) and Jens Mannanal (Founder of Bluerails, a w3.fund portfolio company).

The discussion highlighted the stark contrast between traditional and blockchain-based financial transfers. While a €100,000 international bank transfer can cost €400-800, a comparable transaction on Solana costs approximately $0.50.

Key takeaways from the panel:

Remittances: Traditional money transfers to countries like India can lose up to 20% in fees, demonstrating a significant use case for stablecoins in cross-border payments.

B2B Adoption: Beyond remittances, stablecoins are gaining traction in business transactions by eliminating double FX conversion fees common with traditional payment processors.

Regulatory Progress: The GENIUS Act in the US has created a favorable framework for stablecoin development and adoption.

Yield Generation: Yield-bearing stablecoins offer businesses a compelling advantage—generating returns on operational capital that would otherwise sit idle, making the case for adoption particularly attractive to CFOs.

Please note: w3.ventures is in final closing and is still able to onboard new capital this month. Contact us if you want to seize the opportunity!

Don’t go to jail, stake with a top performing validator

At this years w3.fund AGM, Tim (w3.fund Partner & w3.labs Founding investor) and myself presented our own staking history, which is also the story of how w3.labs came to be. While staking funds for our own private portfolios and for family offices, we discovered that there were no quality staking solutions available that allowed stakers in Germany to stake in a secure, user friendly and compliant way. This led us to spend countless hours on engineering and considerable capital on lawyers to develop a brand new staking platform for first of all Ethereum. We effectively used our knowledge and experience to create a solution that is available to anyone who wants to stake at least 32 ETH. Let's start by examining staking and existing solutions before presenting our approach.

What is Staking?

Cryptocurrency staking involves allocating digital assets to validators who secure blockchain networks. Stakers provide liquidity while validators handle the technical operations, with rewards split between both parties based on predetermined ratios.

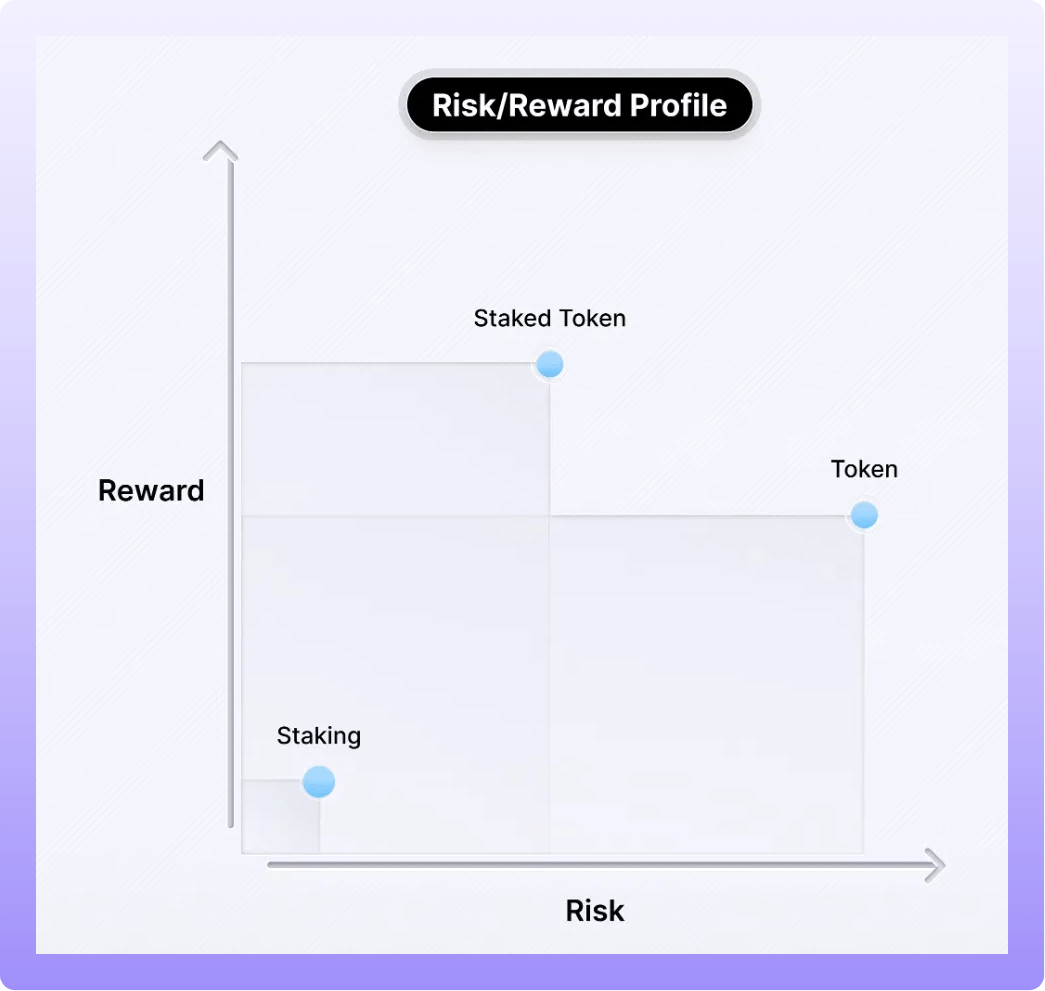

The Innovation: Staked Tokens

Staking creates a new asset class that bridges traditional finance and crypto. Unlike volatile tokens or low-yield bonds, staked tokens offer a balanced risk-reward profile - higher potential returns than government bonds but lower volatility than regular cryptocurrencies.

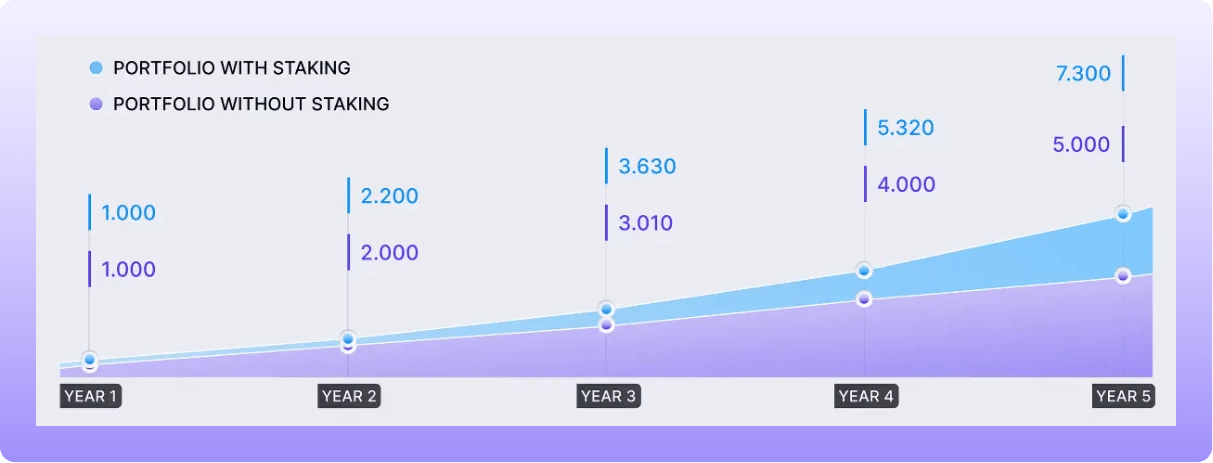

The process involves three simple steps: stake assets, secure the chain, and earn rewards. If you are staking and compounding your rewards, you can significantly increase your stack and profit more form price increases, as seen on the chart below.

Types of Staking Solutions

Exchange Staking

Advantages: User-friendly interface makes it accessible for beginners; simple deposit, purchase, and staking process on a single platform

Disadvantages: "Not your keys, not your coins" - users don't maintain custody of their assets; potential risks from exchange security breaches ("clawbacks")

Liquid Staking

Advantages: Staked tokens can continue being used as collateral or in DeFi protocols, maximizing capital efficiency

Disadvantages: Interactions with liquid staking pools are treated as taxable swap events; adds complexity on top of existing protocols; pseudonymous participation lacks direct human oversight

Validation

Advantages: Self-custodial approach maintains full control of assets; contributes directly to network decentralization without relying on third parties

Disadvantages: Requires technical infrastructure setup and operation; complex regulatory and tax compliance requirements; high accounting complexity for tracking rewards

w3.labs Staking

Advantages: Combines self-custody with regulatory safety; maintains easy-to-use interface similar to exchange platforms

Key Challenges

The main hurdles for staking adoption include navigating complex regulatory requirements (KWG, WpIG, MiCA), managing tax implications from frequent reward distributions, maintaining proper documentation for compliance, and addressing the risk of activities being classified as commercial ventures with significant tax consequences.

This emerging sector shows promise for bridging traditional finance with blockchain technology while addressing regulatory compliance needs.

The w3.labs Solution w3.labs addresses these challenges through compliant staking infrastructure featuring:

Enterprise-Grade Security: German-based infrastructure with pending ISO-27001 certification and institutional-focused system design

Regulatory Compliance: Platform audited by Osborne Clarke for compliance with German Banking Act (KWG), Securities Institutions Act (WpIG), and European MiCA regulation

Tax Optimization: Activities remain neutral regarding commerciality for individuals and asset managers; users maintain beneficial ownership to avoid tax complications; self-triggered reward claiming provides control over tax timing

Comprehensive Reporting: Built-in profit and tax reporting functionalities with detailed token holdings and income tracking

Legal Certainty: Operations within German legal framework enable participation without additional regulatory implications for clients

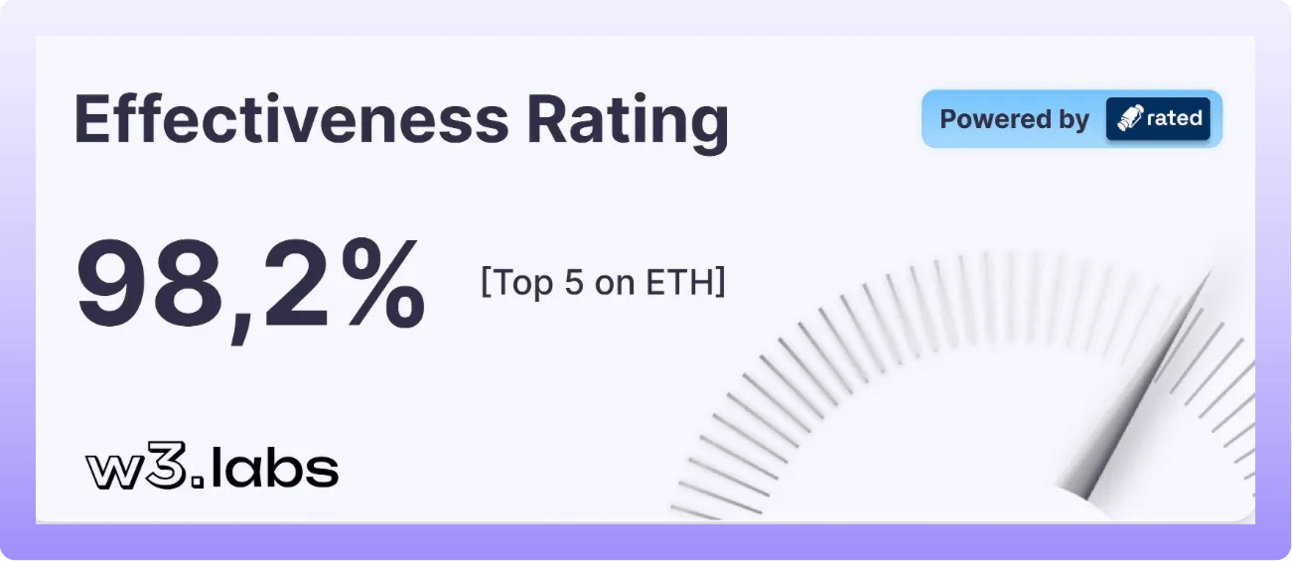

You can be sure get top performance when staking with us, which is als confirmed by our position on the rated.network leaderboard, where we are currently ranked in the top 5 of all Ethereum validators.

Get started with w3.labs

Ready to experience the benefits of Ethereum staking? Getting started with w3.labs is simple. Visit our website at w3labs.xyz/stake-with-us to learn more about our staking services and how we can help you maximize your returns while minimizing risk and complexity.

Also, you can watch this short Loom video to see how easy it is to stake with us:

Highlights from w3.group

Berlin Blockchain Week 2025 is in the books! You can have a look at what happened at w3.hub here:

Berlin’s Home of Web3

In 3 years, w3.hub has become the go-to space for builders.

Hundreds of events, endless connections.

What we offer our community ↓

— w3.hub (@w3_hub)

2:08 PM • Jun 23, 2025