- Web3 Investor Briefing by w3.group

- Posts

- Web3 Investor Briefing | November 2025

Web3 Investor Briefing | November 2025

Every month we provide you with insightful deep-dives into the world of Web3 investing.

Welcome to this month's investor briefing featuring our latest analysis, findings and strategic insights from the Web3 ecosystem.

TL;DR

Julius from w3.wave explains that Bitcoin is undergoing a "silent IPO" and that we are experiencing a healthy consolidation phase rather than a market breakdown.

Henrik from w3.ventures provides a deep dive into the new payment processing protocol for agents on the Internet, named x402.

Bitcoin's “Silent IPO” – Supply finally meets institutional-grade demand

After a volatile October, markets enter November still digesting the sharp but ultimately short-lived flash crash of October 10th. While prices were consolidating around the key psychological level of $100k, for a while we have since seen a rapid sell-off to $90k, displaying a clear trend reversal in the market. Despite this recent price action we believe it’s time to zoom out and understand the broader dynamics at play.

In our view, the current distribution should be seen as the culmination of an important structural shift, something that was recently described as Bitcoin’s “silent IPO.” in a great blog post (you can read the entire post here)

Bitcoin has so far operated on long-term cycles, historically defined by a four year pattern. But with the introduction of spot ETFs, public treasury vehicles, and new institutional infrastructure, this cycle is different - particularly in the way capital enters and exits the market.

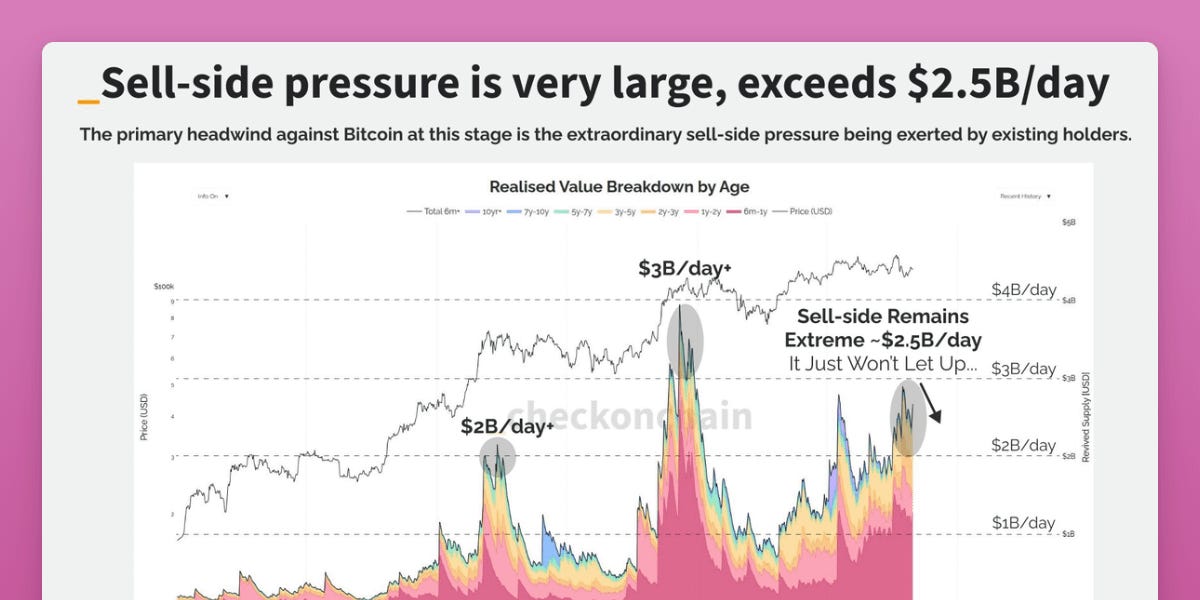

In many ways, 2025 represents Bitcoin’s first true moment of exit liquidity at scale. Long-term holders, including those who acquired coins back in 2015–2017, are now stepping into the bid and realizing multi-billion dollar profits. The scale of this realization is hard to overstate:

Nearly $572 billion in revived supply (i.e. older coins being moved/sold) has come to market since the last cycle lows, of which $295 billion occurred in 2025 alone.

By comparison, that’s 15x more revived supply than what we saw during the entirety of the 2020–21 cycle.

This behavior mimics what we typically see after IPOs, early backers taking profits into a newly liquid market.

So far, this sell-side has been absorbed by a maturing market infrastructure, but it also explains why price has struggled to break higher despite strong narratives and continued retail interest. It’s not that Bitcoin is weak, it’s that the market is successfully absorbing a historic amount of profit-taking.

And while the idea of a massive distribution might sound scary at first, there are plenty of examples in the equities market, where companies went through a similar phase before continuing tremendous rallies in the years after.

ETF Flows & Treasury Demand – Drying up at the wrong time

One notable difference between Q1–Q2 and the current environment is the lack of new institutional inflows. While ETF launches and the emergence of digital asset treasury (DAT) companies were major tailwinds earlier in the year, that momentum has slowed:

ETF net inflows have been muted since late summer.

DATs are now mostly trading at or below 1.0x mNAV, meaning they are unable to raise capital via share issuance (a key mechanism for deploying capital into crypto assets).

Trading volumes of DATs have trended down, limiting their operational capacity and ability to support price via net buying.

These data points matter, because institutional flows are the lifeblood of the current cycle. Unlike previous cycles where retail FOMO led the charge, this market has been structurally driven by professional capital and that capital is now on pause.

Until volumes pick up and mNAV multiples re-expand, we expect institutional net buying to remain limited, which is a key risk to monitor.

And while this is arguably bearish for the moment, we have seen in previous rallies that ETF flows can be described as trend-following. It is not the capital that is buying the bottom, but rather jumps on the train once we build momentum.

Capitulation, Cost Basis, and Absorption

Despite the lack of fresh institutional demand, we’re seeing signs that short-term holders are capitulating, thereby potentially marking a local bottoming process.

On-chain metrics like STH-SOPR have dropped way below 1.0, signaling losses being realized on spent coins.

Over 29% of the Bitcoin supply is now at a loss, concentrated among recent entrants.

Yet, the average unrealized loss remains manageable (~9%), meaning we’re not yet in full fear mode, which is something that has caused previous bear markets to worsen.

In addition, coins acquired during the 2022–2023 accumulation period (cost basis: ~$22k–32k) have now appreciated 4x–5x. Profit-taking in this cohort is both natural and healthy, and again speaks to the maturity of this market to absorb large volumes of seller activity without breaking down structurally.

The Current Structure: Correction or Collapse?

We believe it’s premature to call for a full-blown cycle top. Instead, the current environment looks like a multi-month consolidation phase, driven by:

Long-term holder distribution into liquidity

Absence of fresh institutional inflows

Short-term holder capitulation

Key technical levels still holding

Should ETF flows re-accelerate, or treasury companies regain issuance capability (e.g. via rising mNAVs and volume), we believe the market is well-positioned for another leg up.

Conversely, if sell pressure continues and macro conditions deteriorate (e.g. stronger USD, delayed rate cuts, Mag7 weakness), we would likely see a prolonged correction.

It’s the macro, stupid.

And while we continue to monitor the above-mentioned crypto-related metrics on a day to day basis, it is once again the macro backdrop that has shaped the recent sell-off in markets.

Since September of this year, we have seen a continuous tightening of liquidity conditions in the US. This was partly due to the rebuild of the TGA (the Treasury General Account) which has pulled over $600bn in liquidity from markets. Further, the FED is still in QT mode, rolling of longer-maturity papers from their balance sheet.

This has accumulated in significant stress in the US banking sector, where overnight rates continue to spike and climb up, sending a clear message of dwindling liquidity in the markets. And while the FED has announced it will end their QT program on December first, we have yet to see a pivot from the central bankers in terms of managing the market liquidity.

It was reported that the FED held an emergency meeting with prime brokers and banks last week to discuss the current stress in the system and now the focus shifts towards their next steps. For us the key question is the following: how much more pain is the FED willing to take before they are forced to inject liquidity into the system?

The crypto markets have front-run much of this negative development over the past weeks and it will be interesting to see where we find a bottom given the questionable liquidity picture.

x402 Deep Dive: Payment Rails for the Age of Autonomous Agents

If you've ever tried to pay for an API call, you know the friction: Create an account, enter credit card details, choose a subscription tier, wait for approval, set monthly limits and deal with billing cycles. All of this just to access a simple web service.

Now imagine an AI agent trying to do the same thing. It can't. And that's the problem the new payment processing protocol for agents on the Internet, named x402, is designed to solve. Explore with us how crypto could be the only viable payment method for AI agents.

The Real Problem: The Internet Was Built Without Payments

Here's something most people don't realize: the modern web has a fundamental design flaw. When Tim Berners-Lee and the early internet architects built HTTP, they included the status code “402: Payment Required”, but never actually implemented it. For over 30 years, this code sat dormant in every web server, a placeholder for a future that never came.

Instead, we built elaborate workarounds: credit card processors, API key management systems, subscription models, invoicing infrastructure, and customer support teams to handle it all. These systems work fine for humans making occasional purchases, but they're completely incompatible with the future we're rapidly entering: one where AI agents need to transact autonomously, instantly, and at micropayment scale.

Traditional payment rails fail spectacularly when you need to:

Pay $0.0001 for a single API call (credit card fees make this impossible)

Transact without a bank account (billions of people and all AI agents don't have one)

Settle payments in 200 milliseconds (traditional rails take days)

Operate 24/7 globally (legacy systems have business hours and geographic restrictions)

Avoid subscription commitments (why pay monthly when you only need something once?)

The Future Problem: Agentic Commerce at Scale

The timing of x402 isn't coincidental. We're witnessing the emergence of truly autonomous AI agents: Systems that can browse the web, call APIs, purchase services, and complete complex multi-step tasks without human intervention. Goldman Sachs estimates agentic commerce could become a $30 trillion market.

But here's the catch: these agents can't function in today's payment infrastructure. They can't fill out credit card forms, pass KYC checks, manage API keys across hundreds of services or commit to monthly subscriptions when their needs are sporadic and unpredictable.

Imagine an AI research agent that needs to:

Query a specialized database ($0.05)

Run a computation on a distributed network ($0.12)

Access proprietary data from three different providers ($0.08 each)

Generate a visualization ($0.03)

Store results in decentralized storage ($0.02)

Under today's system, each step would require separate accounts, subscriptions, and payment methods. With x402, the agent simply executes each transaction inline with the HTTP request allowing for instant settlement without setup and friction.

How x402 Actually Works

Developed by Coinbase and recently integrated into Google's Agent Payments Protocol (AP2), which is backed by Mastercard, PayPal, Stripe, and 60+ other organizations, x402 resurrects that unused HTTP 402 status code and makes it work with stablecoin payments on blockchain rails.

When an AI agent hits a payment-required endpoint:

Server responds with HTTP 402 plus payment details

Agent's wallet automatically signs and sends the stablecoin payment

Transaction settles in ~200ms on Layer 2

Server receives confirmation and delivers the service

Total cost: fractions of a cent, no account needed

It's pay-per-use at its purest form: No subscriptions, no minimum balances, no geographic restrictions, no intermediaries taking cuts.

Are you still having trouble wrapping your head around this new technology? Here is a showcase by Crossmint and Coinbase in which their agents have a poker duel and use the x402, for example, to pay for research:

Why This Matters for Web3

The x402 protocol represents something we've believed in since day one at w3.fund: The best Web3 solutions don't just replicate Web2, they solve problems that were literally impossible to solve before.

Payments embedded directly into HTTP unlock:

Pay-per-use APIs that are economically viable at any scale

Truly autonomous AI agents that can transact independently

Global accessibility for anyone with internet access, no bank required

Micropayment economies for content creators, data providers, and service builders

Programmable money that flows as seamlessly as data

The explosive growth speaks for itself: 156,000 weekly transactions with 492% growth since launch. Developers are already building on x402 for everything from decentralized inference networks to paid content access to agent-to-agent commerce.

The Takeaway

x402 isn't just another payment processor. It's infrastructure that fixes a 30-year-old design flaw in the internet itself, arriving exactly when we need it most: At the time of AI agents becoming economic actors in their own right.

For the first time, machines can transact as easily as they transmit data. That's not an incremental improvement. That's a fundamental unlock for the agentic economy.

And we're just getting started.