- Web3 Investor Briefing by w3.group

- Posts

- Web3 Investor Briefing | October 2025

Web3 Investor Briefing | October 2025

Every month we provide you with insightful deep-dives into the world of Web3 investing.

Welcome to this month's investor briefing featuring our latest analysis, findings and strategic insights from the Web3 ecosystem.

TL;DR

Julius from w3.wave discusses the recent flash crash in the crypto market, provides an outlook on the market, and reflects on recent events such as TOKEN 2049 and the Digital Asset Summit.

Henrik from w3.ventures provides an overview of the latest trends in the crypto markets and offers his insights.

Tom from w3.labs analyzes the evolving staking ecosystem and the requirements of institutional stakers.

October 10th Flash Crash – A Historic Market Dislocation

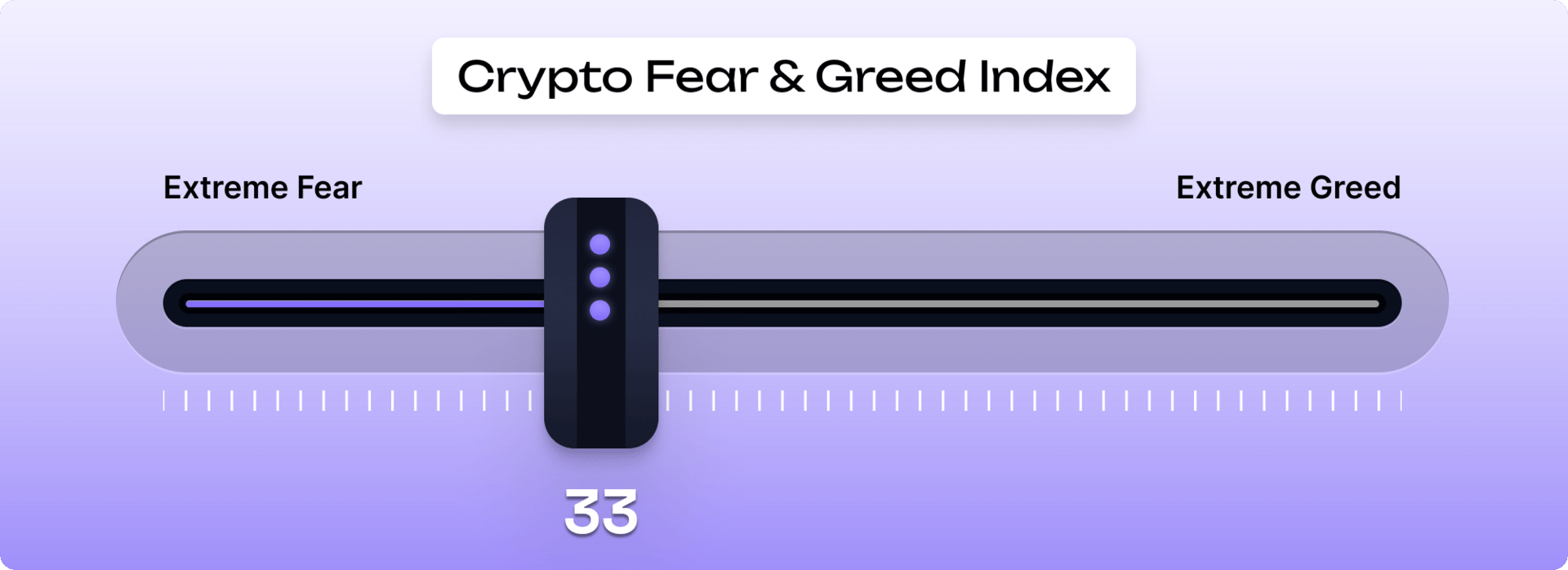

Earlier this month, we witnessed one of the most severe and rapid market dislocations in crypto history. The October 10th flash crash was triggered by an unexpected geopolitical shock: former President Donald Trump announced a new wave of tariffs against China, specifically targeting rare earth exports. Markets reacted immediately. While traditional risk assets saw moderate downside, the crypto market unraveled in textbook “cascade” fashion.

Bitcoin quickly sold off to ~$119k, triggering initial liquidations across leveraged positions. This sell-off snowballed into a full-blown liquidity crisis on major centralized exchanges (most notably Binance) where large market orders collided with thin books. Price dislocations of 70–90% occurred across many altcoins, wiping out over $30 billion in open interest within minutes.

Crucially, DeFi protocols weathered the storm far better than centralized platforms. Throughout the volatility, decentralized venues continued to process transactions without interruption — a reminder of why decentralized infrastructure matters.

At w3.wave, we were not immune to the broader correction, but our long-standing principle of avoiding leverage helped us navigate the event without structural damage. We’ve seen a lot in these markets, but this event stands out as one of the most violent deleveraging cycles in crypto’s short history.

Post-Crash Market Dynamics

While many assets have rebounded partially since the event, the crash has left a mark on investor sentiment and market structure. A few key takeaways:

Binance's fragility was on full display. With its market share still dominant, the venue's inability to maintain liquidity during extreme volatility is a structural risk that should not be ignored.

Altcoins remain under pressure, and we expect further dispersion in performance. Quality and fundamentals are becoming more important in investor allocation decisions.

Liquidity remains fragile, particularly in the long tail of tokens. Institutional players may reassess counterparty and venue risk as a result.

Despite the short-term damage, we remain constructive on the medium-term outlook. Crashes of this nature often serve as forced resets, flushing excess leverage and creating conditions for healthier price discovery ahead.

Macro Remains Supportive

In contrast to the chaos in crypto markets, the broader macro backdrop continues to improve:

The September FOMC confirmed the Fed’s dovish pivot. A rate cut now seems firmly on the table for Q4, and inflation data continues to support a gradual easing cycle.

Equities and commodities remain strong, with gold and oil hitting multi-year highs. We still believe Bitcoin is due for a catch-up to this last Gold ralley.

Institutional interest in digital assets is undiminished. Despite short-term volatility, flows into ETFs and digital asset treasury companies remain positive on a net basis.

We believe the current environment, driven by rising liquidity and structural crypto adoption, continues to favor long-term accumulation.

The team on the road - Insights from Token 2049 Signapure and Digital Asset Summit in London

As part of our ongoing commitment to staying close to the pulse of the market, the w3.wave team spent the past weeks on the road attending some of the most relevant industry gatherings. These events offered valuable insights into how the institutional and builder community is approaching this next chapter of crypto markets.

TOKEN2049 Singapore – Asia Rising

Rather than focusing on the main conference stage, we chose to spend our time at side events and private sessions and the quality of conversations with founders, investors, and ecosystem players was outstanding.

Key takeaways:

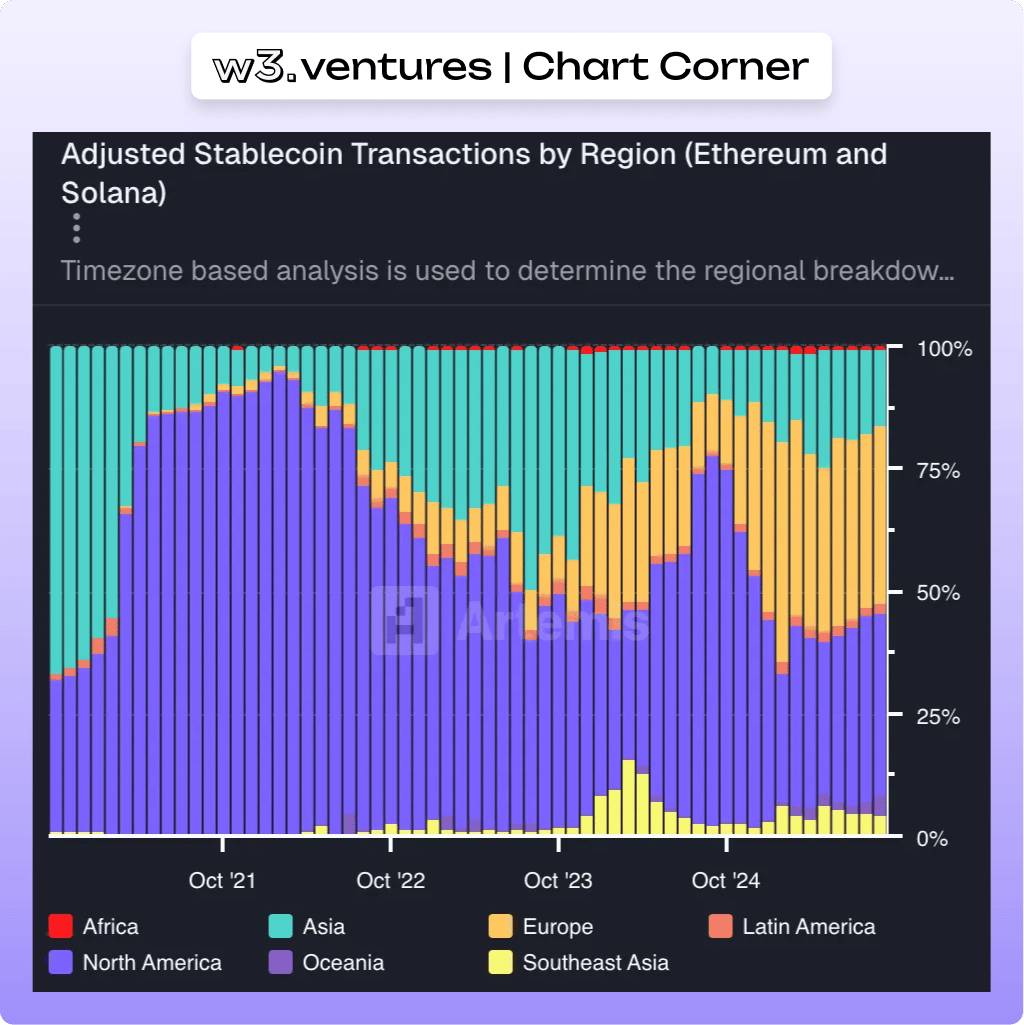

Asia is (once again) leading the charge. The energy across the region is undeniable, with Singapore emerging as a strategic hub for both innovation and capital allocation in crypto.

Institutional presence has matured. From sovereign wealth funds to multi-family offices, the conversations were far beyond the exploratory stage. These allocators are actively seeking exposure.

The “DeFi mullet” is becoming reality. User-friendly fintech front-ends with DeFi infrastructure on the backend is a theme that came up repeatedly — and resonates with our team, given our previous experience building in this space. It’s likely to be one of the next adoption drivers.

AI x Crypto is just getting started. Beyond the hype, the intersection of decentralized infrastructure and AI was a dominant topic — particularly around privacy, data ownership, and verifiability.

East vs. West divergence. While Western markets are focusing on tokenization and compliance-first frameworks, Asia is pushing the envelope on user adoption, liquidity, and experimentation.

Overall, the tone was constructive, long-term oriented, and a welcome reminder that real innovation happens far away from the daily volatility and headlines.

Digital Asset Summit London – Institutional Interest Going Deep

Julius visited the Blockworks Digital Asset Summit in London, one of the more institutional-focused conferences on the calendar, with strong representation from asset managers, financial infrastructure providers, and regulated institutions.

Key takeaways:

TradFi is convinced blockchain is the better infrastructure. There is growing consensus that the question is no longer if but how and when blockchain will be integrated into core financial infrastructure.

DeFi is about to professionalize. What is still often perceived as risky “on-chain gambling” will evolve into real financial tooling. Teams are building rating agencies for liquidity pools, abstracted integration layers, and fixed-yield products to meet institutional standards.

The adoption bottleneck has shifted. With Bitcoin allocations now accepted in most institutional circles, the focus is shifting toward enabling scalable demand for broader crypto assets — tokens that reflect real utility, usage, and cash flow.

What stood out was the depth of conversation, from allocators to DeFi builders, the discourse reflected a maturing market searching for structure, transparency, and long-term use cases.

Hot Topics / Current Trends (Q4 2025)

As mentioned in the w3.wave section, the market is currently in an ideal phase for accumulation and this is typically characterized by different “hyped” topics in different market sectors. For this reason, we decided to provide an overview of the various interesting trends that we’re currently observing.

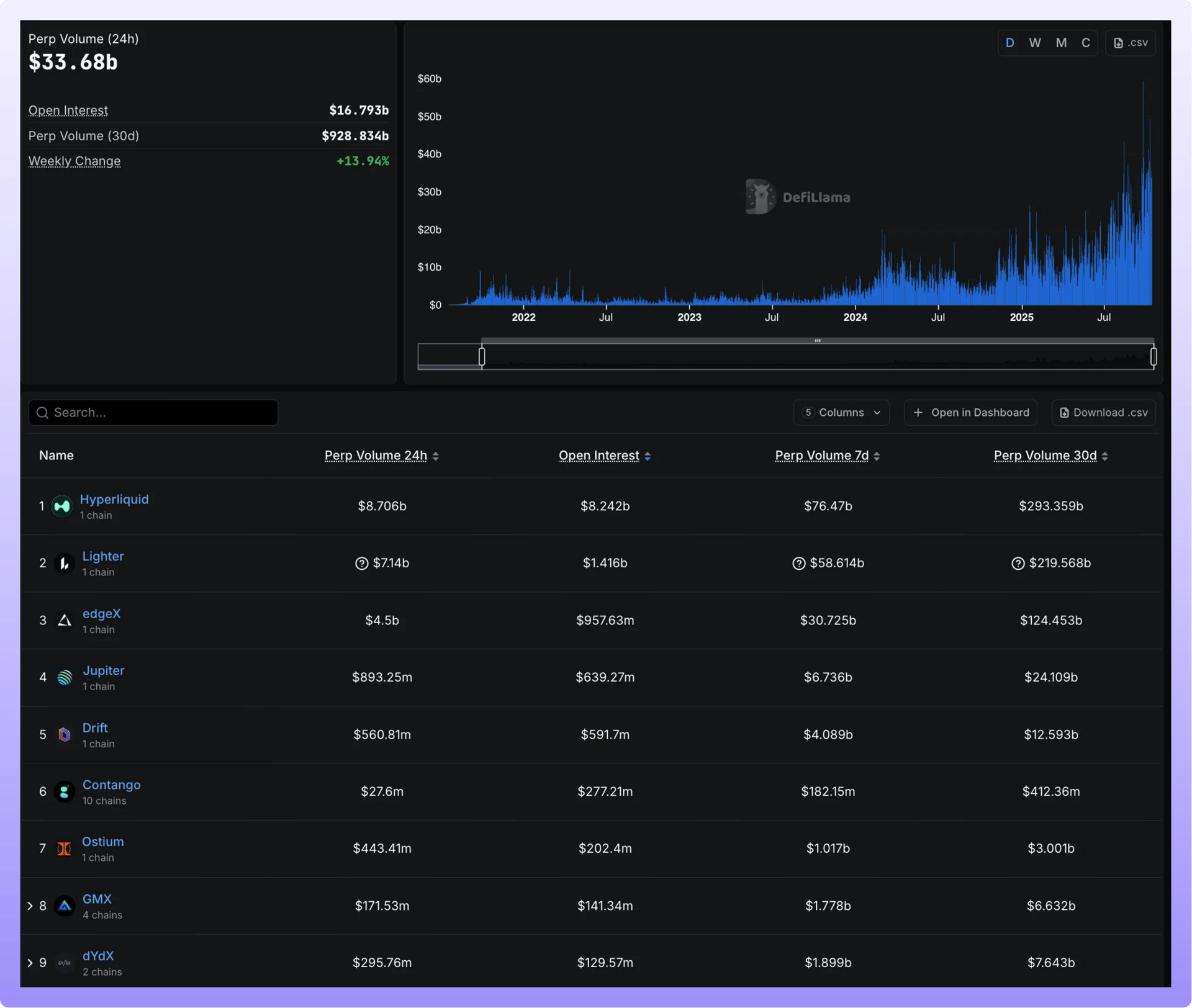

Perpetual futures and the DEX surge

On-chain activity is accelerating, and derivatives are becoming the natural convergence point between degens, airdrop farmers, and institutional traders. Decentralized perpetuals are gaining popularity (e.g., Hyperliquid, Aster, and Lighter) as builders ship faster and traders move on-chain. While Hyperliquid's success and the wealth effect of its airdrop certainly played a role in the sector's growth, it seems as if a larger trend has been ignited.

This is not a new idea: Centralized crypto perpetual swaps were popularized by BitMEX in 2016. Since then, decentralized perpetual swaps have matured, with early pioneers like dYdX (founded in 2017) now running on a fully decentralized chain. The case for decentralized perpetuals rests on:

Self-custody and non-custodial execution (no exchange-held funds).

Permissionless market access and DeFi composability

Verifiable fairness via zk-proofs on next-gen engines (e.g., Lighter's zk-verified CLOB).

Why now? On-chain throughput and user experience have improved with custom appchains and on-chain volumes are at cycle highs. This is effectively enables decentralized protocols to attract the customer base of centralized exchanges.

Venue | Founded/Launch | 24h Volume | Open Interest | Users / Notes |

|---|---|---|---|---|

Hyperliquid | L1 launched 2024 | $11.48B | $7.55B | ~518k addresses by end ‑ H1 2025 |

Aster | 2025 | $1.04B | $0.26B | Volume methodology disputed; DeFiLlama delisted perp data (possible wash-trading) |

Lighter | Private beta Jan 2025 | $7.07B | $1.50B | a high‑speed exchange that uses cryptographic proofs to verify every order‑book trade |

dYdX (Chain) | 2017 (project); chain 2023 | $0.30B | $0.14B | 267 markets; non‑custodial |

Drift (Solana) | 2024+ | $0.57B | $0.52B | 200k+ traders by end‑2024 |

Prediction markets and “publisher‑exchanges”

Markets where people bet on real‑world events are coming back, but the bigger change is that trading is being built right into the apps we already use.

ANNOUNCING: Polymarket live tickers.

Live-streaming prediction market content? You can now embed our Polymarket tickers straight into your stream.

Get started: ticker.polymarket.com

DM us if you need support

— Polymarket Traders (@PolymarketTrade)

2:11 PM • Oct 3, 2025

Quick definition: A publisher‑exchange is a consumer app that lets you discover content and trade on it in‑place.

These “publisher‑exchanges” let you discover, create, and trade directly inside chats, live streams, and social feeds, so the gap between seeing information and acting on it gets much smaller. That’s why platforms like Polymarket, Kalshi, Myriad, and Limitless are getting more attention.

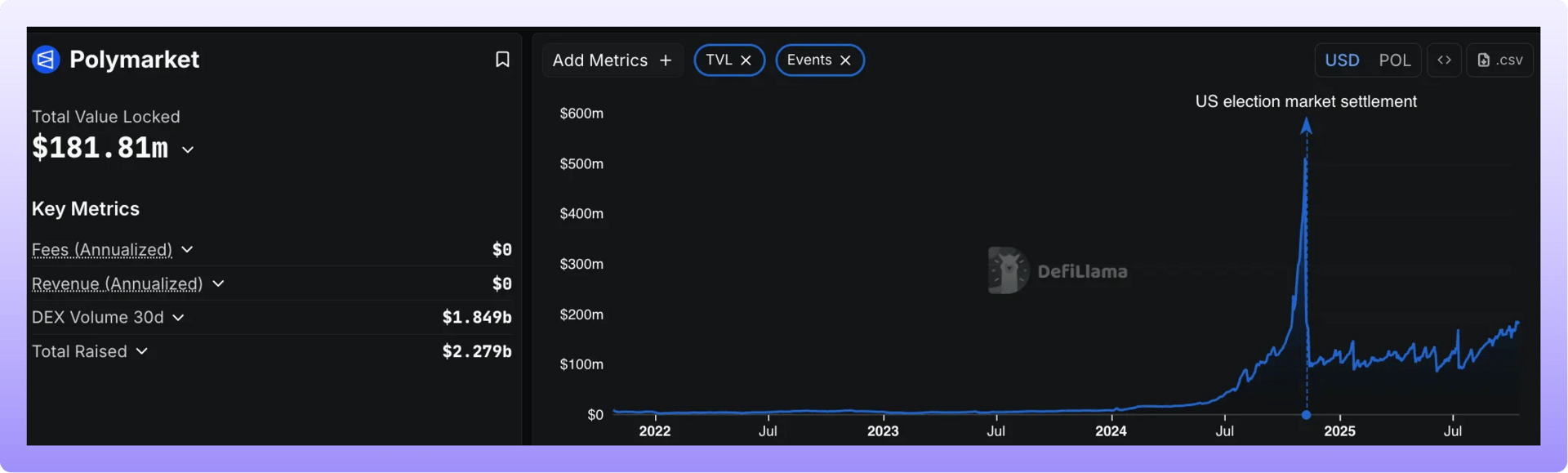

A quick history and why now: the 2024 U.S. election brought prediction markets into the mainstream, with Polymarket’s election market surpassing $3B in volume. Polymarket remains the OG crypto prediction venue, while Kalshi’s expansion accelerated after a federal appeals court allowed it to offer U.S. election betting. New entrants like Myriad and Limitless are pairing novel market formats with consumer-native UX.

Tailwinds:

Publisher‑exchange UX that embeds markets directly in chats/streams

Better data and oracle plumbing

On‑chain identity and payments that reduce KYC/settlement friction for compliant venues

Rising demand for real‑time, tradeable information during high‑attention events (elections, sports, culture)

Privacy as a prerequisite for adoption

In our view, privacy is essential for mainstream use: businesses need confidentiality for pricing, counterparties, and payroll; institutions require policy‑compliant privacy with audit trails; and individuals need baseline financial privacy for safety and civil liberties.

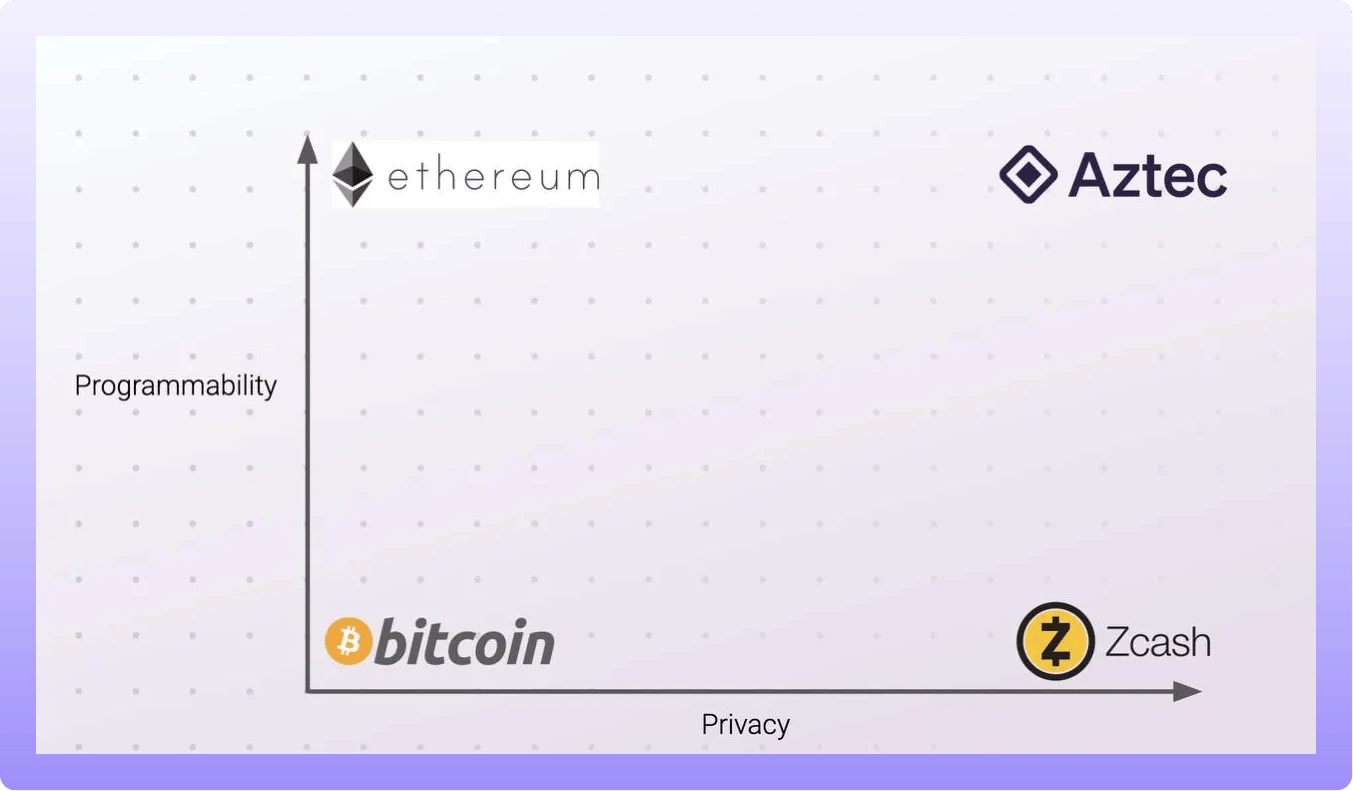

Zcash brought practical on‑chain privacy with zk‑SNARKs and selective disclosure, while Monero took a privacy‑by‑default path.

What’s next: solutions like Aztec are building encrypted L2s with private smart contracts, and more privacy‑preserving compliance tools are shipping to let apps prove compliance without exposing user identities.

Expect winners to combine easy user privacy and compliance with intuitive product flows.

Stablecoins and tokenized yield go mainstream

The adoption and boom of stablecoins is nothing new to us, but some concepts that are surfacing now have a new quality to them. They are further removing the barriers through innovative and purpose-built infrastructure or new forms of yield e.g. through AI investments.

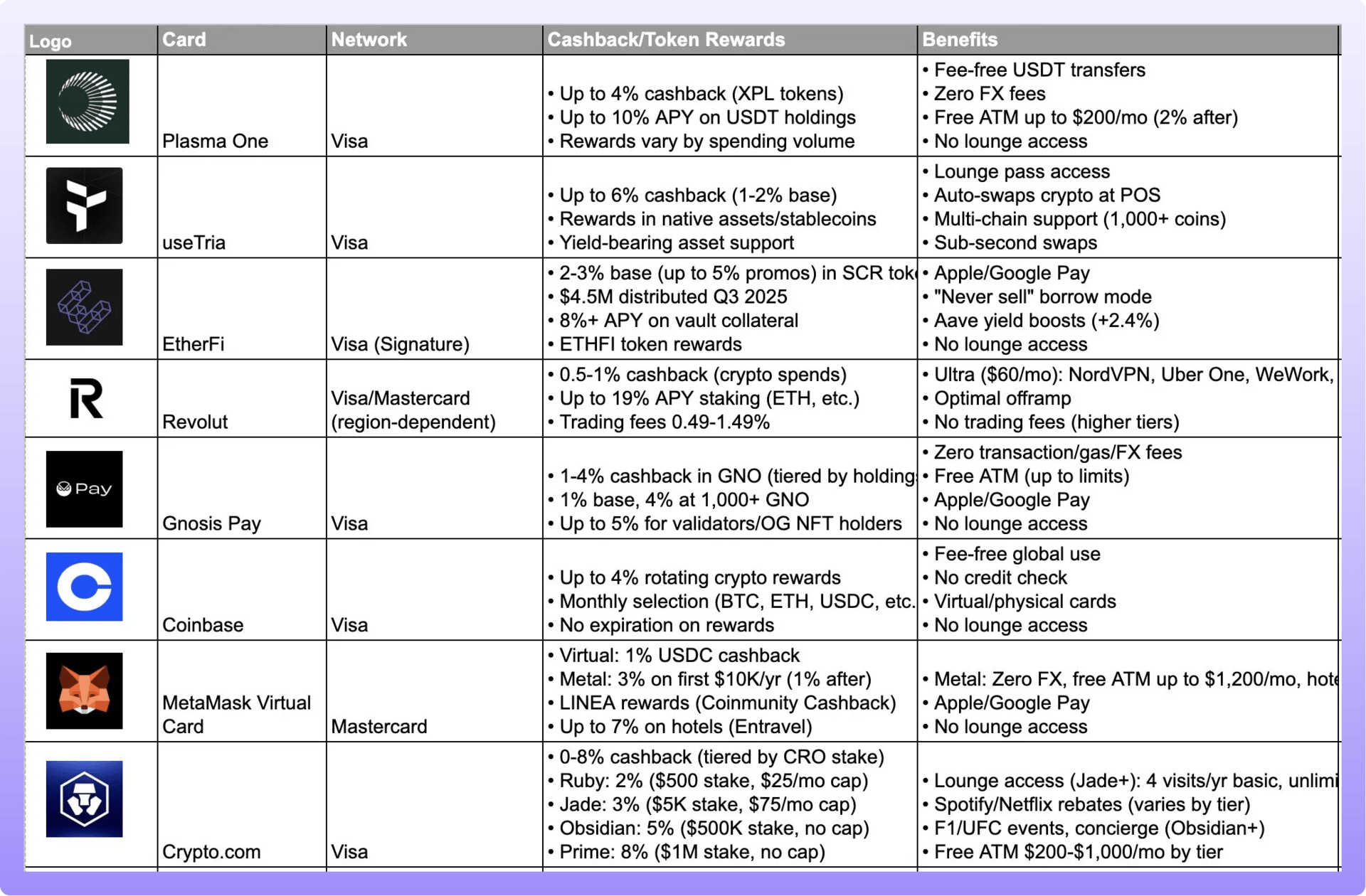

Plasma and Plasma One: Plasma is a stablecoin‑native L1 that powers zero‑fee USDT transfers and instant USD payments; its native token XPL handles gas, staking, and governance, while Plasma One provides a neobank + card to spend stablecoin balances globally and earn yield.

USDai: a dual‑token synthetic dollar where USDai provides stability and staked sUSDai accrues AI‑linked yields from GPU financing and Treasuries. Even though they are mostly stable at 1$, we would define these tokens as investment vehicles rather than stablecoins.

Tria: chain‑abstracted payments and neo‑banking stack with “BestPath” routing so people and AI agents can pay, swap, and settle across chains, plus cards and merchant integrations

Our take for builders and investors

We hope you enjoyed this overview of the latest developments in the crypto market. For the coming months, we recommend the following: Stay receptive to emerging trends, but also pause occasionally to assess their viability and long-term applicability. Categorize them as either sustainable, long-term investments or short-term speculative plays, and approach them accordingly.

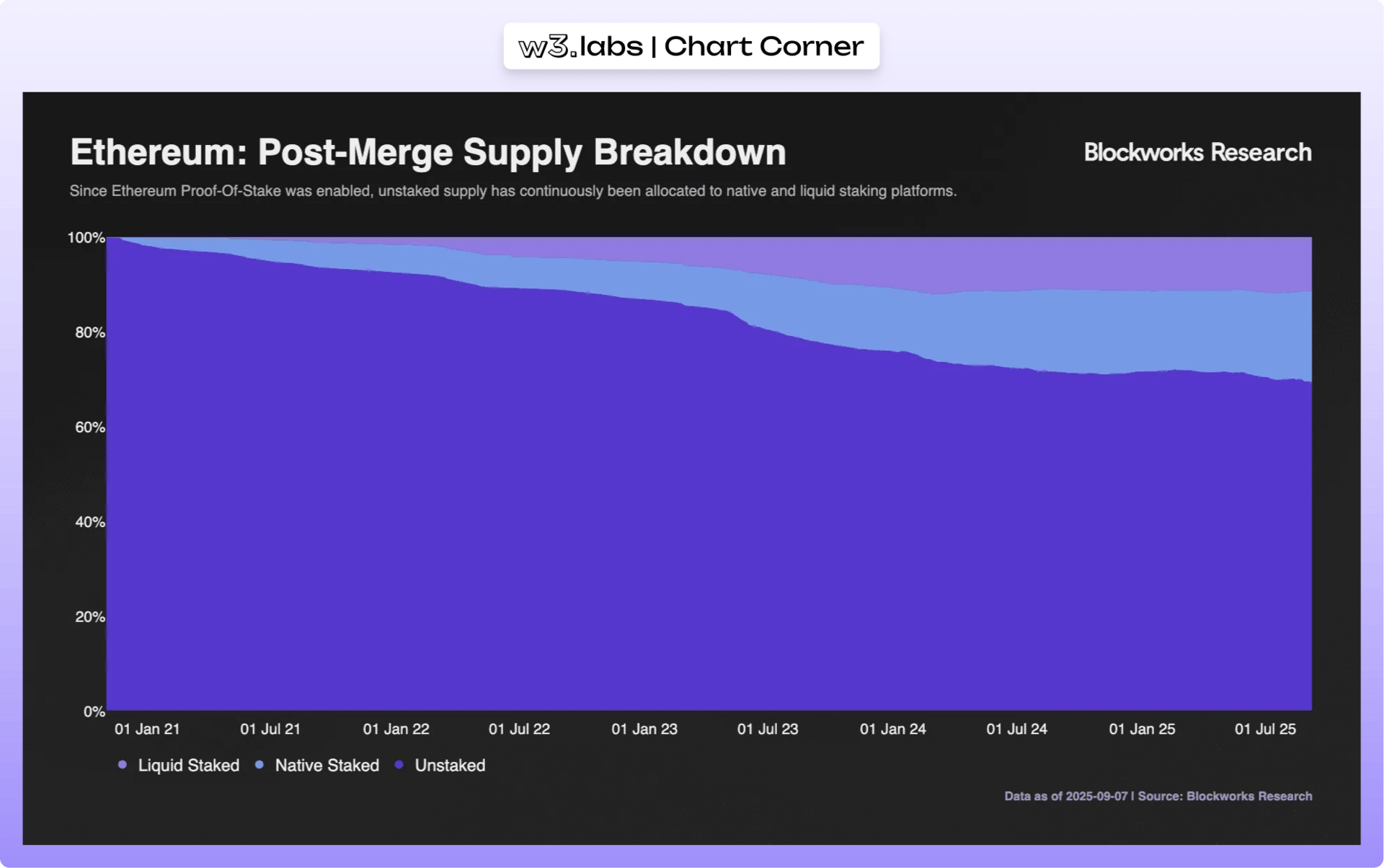

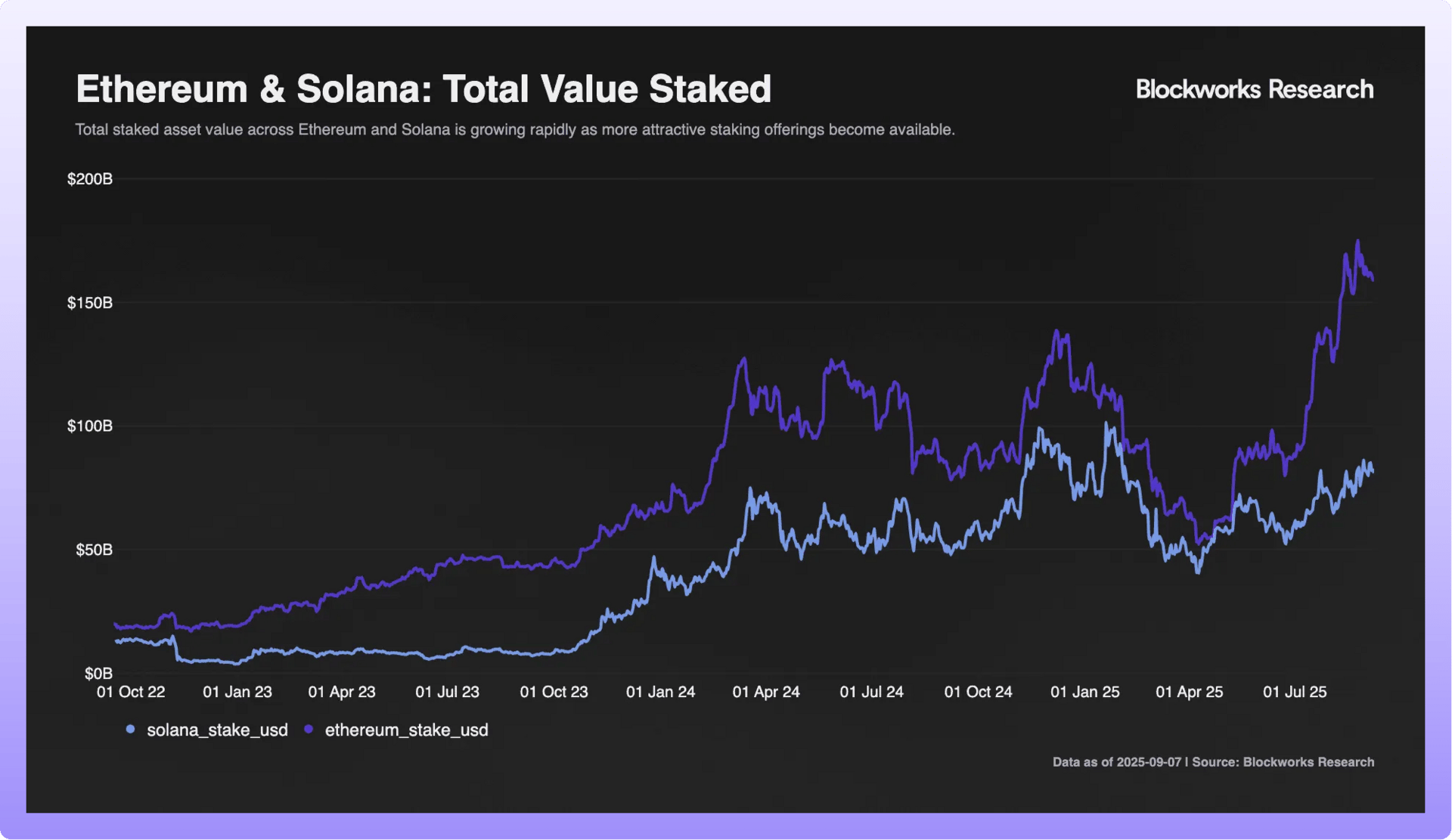

Staking Infrastructure: Why “secure, non‑custodial, compliance‑first” wins and how w3.labs leads

If you look at Blockworks Research’s chart of total value staked on Ethereum and Solana, the direction is unmistakable: staking has become core market infrastructure. Ethereum alone sits at over 30% of supply staked, representing more than $169B secured value, while Solana has ~66% of supply staked and roughly $97B staked.

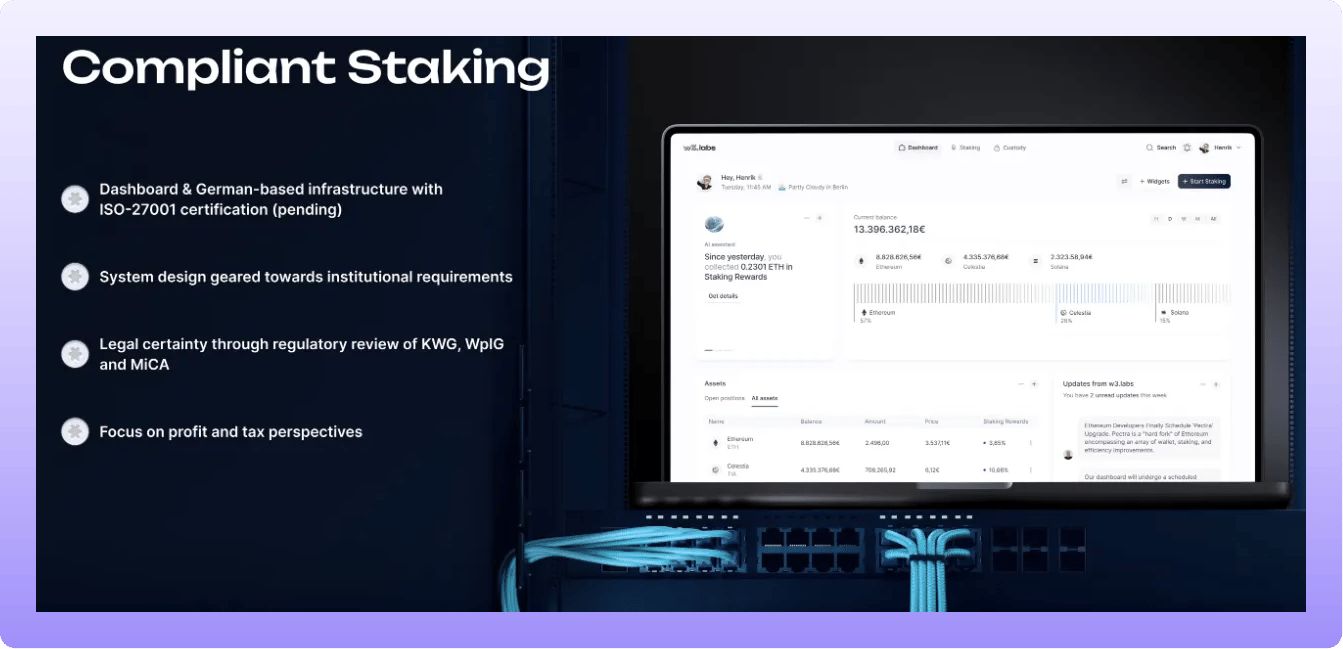

Institutional staking is no longer about who can spin up the most validators; it’s about where you operate, how you align with regulators, and the policies you adopt to balance compliance with rewards.

Blockworks Research calls this out directly in their latest “Institutional Staking Briefing”: As rules formalize, local presence and licenses are becoming decisive. At the same time, providers increasingly compete on how they navigate the tension between regulatory compliance and protocol‑level reward maximization, for example, choosing to forgo timing‑sensitive MEV strategies that might raise policy questions, or offering tiered choices aligned to a client’s risk‑reward profile. And underpinning it all is the broader shift to secure, non‑custodial architectures with robust compliance frameworks as the default institutional standard.

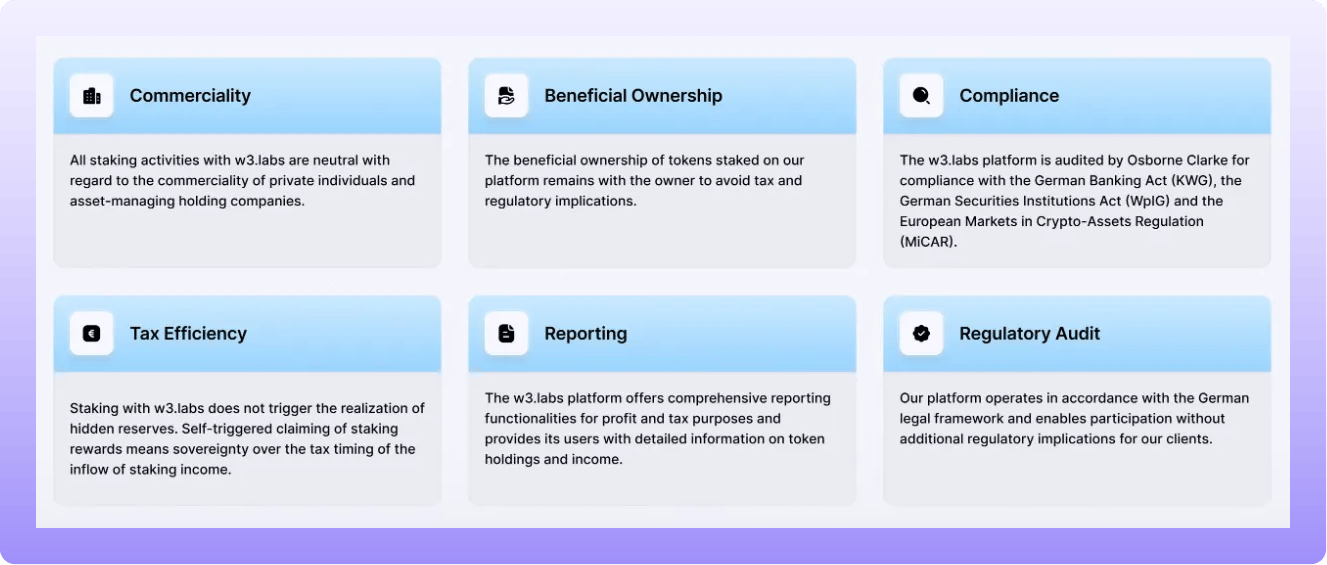

w3.labs Staking Advantages

w3.labs’ strategy is built for exactly this environment. We operate Germany‑based infrastructure and run a platform audited by Osborne Clarke for alignment with the German Banking Act (KWG), the German Securities Institutions Act (WpIG), and the EU’s MiCA regulation. In practice, that means delegated, non‑custodial staking where beneficial ownership remains with you and reward claiming is under your control.

On the “compliance vs. rewards” trade‑off, our stance is simple: compliance comes first, and yield is earned within those guardrails. Blockworks Research notes that providers are differentiating on policy choices around timing‑sensitive MEV and other strategies. We prioritize regulatory alignment, clean custody lines, auditable processes, and evidence; not timing games. That’s why our product design emphasizes beneficial ownership, self‑triggered reward claiming, and comprehensive reporting, so you can meet internal policy and audit requirements without giving up operational efficiency. Where institutions want to calibrate their risk‑reward profile, we approach that through policy‑led configuration and documentation, not aggressive tactics that could compromise network health or regulatory posture.

Jurisdictional positioning matters just as much. Institutions increasingly prefer providers licensed or operating in their region, and we’re focused on serving Europe with an audited, Germany‑based setup that maps to the frameworks your teams already work with. The result is a partnership that meets regulators and auditors where they are: non‑custodial staking, EU‑grade controls, tax‑aware flows, and enterprise reporting delivered in a way that fits institutional governance rather than fights it.

:max_bytes(150000):strip_icc()/GettyImages-2237775715-ff3c8ac79cf64cd1a8d44ef6efa8de0c.jpg)