- Web3 Investor Briefing by w3.group

- Posts

- Web3 Investor Briefing | January 2026

Web3 Investor Briefing | January 2026

Every month we provide you with insightful deep-dives into the world of Web3 investing.

Welcome to the first investor briefing of 2026 featuring our latest analysis, findings and strategic insights from the Web3 ecosystem.

TL;DR

Julius from w3.wave offers valuable context on Bitcoin's price behavior, reviews its price performance in 2025, especially compared to other asset classes, and provides an outlook on the AI and crypto sector.

Henrik from w3.ventures provides an overview of predictions and outlooks for 2026, aggregating the top firms' opinions in the space.

Bottom Formation & Post‑Selloff Accumulation

November marked one of the most significant drawdowns in recent crypto cycles, with Bitcoin breaking below key support around $100k and triggering realized loss capitulation among short‑term holders. Yet, rather than a cascading breakdown, price action since then has shown meaningful stabilization, a pattern often visible during local bottoms rather than full structural breakdowns.

On‑chain sentiment and behavior highlight a nuanced shift:

Realized losses and capitulation have been elevated - a hallmark of short‑term selling exhaustion.

Accumulation signals have emerged as dormant supply begins to re‑enter the market at levels where long‑term holders previously accumulated with confidence.

Despite macro volatility, Bitcoin and major liquid tokens have found support zones near historical cost‑basis levels, and aggressive selling has shown signs of fading relative to October’s peak pressure.

This consolidation framework aligns with technical patterns we would expect if forced selling has largely cleared and strategic buyers begin absorbing supply quietly. Such patterns often precede a period of volatility compression followed by renewed directional moves.

From a risk‑management perspective, this environment suggests that while the market may not be trending, it is also not breaking. Rather, participants are reallocating thoughtfully in light of ongoing macro uncertainty and risk‑adjusted flows.

2025 in Review: Bull Markets Everywhere Except Crypto

2025 will likely be remembered as a year of asymmetric performance across financial markets: traditional asset classes delivered robust gains while crypto broadly underperformed.

In Q4, Bitcoin’s correlation with equities notably weakened, diverging from historical patterns where easing or increased liquidity tended to boost risk assets in tandem. In contrast:

The S&P 500 and Nasdaq 100 climbed while Bitcoin ended the year lower year‑over‑year, even after early cycle gains.

Commodities surged, reflecting safe‑haven demand amid geopolitical and policy uncertainty, a dynamic not mirrored in crypto’s price action. This has led many commentators to question the “digital Gold” narrative for Bitcoin, which in my opinion is a bit premature.

Bitcoin’s correlation with equities hit multi‑year lows, and BTC underperformed equities during a traditionally liquidity‑driven rally environment.

To highlight the structural shift in Q4 2025, we have added the Bitcoin vs. Silver chart below.

At first glance, this divergence may seem disheartening. But dig deeper, and 2025 tells a more nuanced story, one not of structural weakness, but of foundational realignment.

Despite price action, 2025 was in many ways a year of breakthroughs:

Institutional adoption hit record levels, with ETFs pulling in billions and sovereign wealth funds beginning to explore digital asset exposure.

More Bitcoin changed hands than in any prior year, a sign of ongoing redistribution and growing long-term holder conviction.

Application-layer use cases gained real traction, with prediction markets (like Polymarket) exploding in usage and reaching new levels of public relevance.

The conversation around token structure, rights, and value accrual matured significantly, with both founders and investors pushing for clearer fundamentals and improved economic design.

Taken together, these trends suggest the crypto market has been laying groundwork for the next leg of growth. If 2025 was a year of consolidation, 2026 may be the year when fundamentals and adoption reassert themselves as key drivers of performance.

AI + Crypto Infrastructure — The Next Season Is Upon Us

As we close out 2025, a noticeable shift is taking shape at the intersection of artificial intelligence and blockchain infrastructure.

One of the clearest manifestations of this shift has been the surge in agentic AI capabilities, driven most notably by advances such as Claude Code. Claude Code represents a new generation of AI development tooling that goes well beyond simple autocomplete or snippet suggestion - it can independently generate, structure, and implement entire software solutions by autonomously composing and executing code with minimal human input.

What makes this so relevant for crypto investors is that these AI agents are not just capable of writing code - they are designed to interact with APIs, web services, and cloud infrastructure autonomously. That creates a new class of agentic economic activity where AI systems need to transact value with minimal human intervention.

This development dovetails with progress in protocols like x402, an emerging standard being championed by the x402 Foundation and early infrastructure partners that embeds payment logic directly into the web’s request‑response layer using the once‑forgotten HTTP 402 “Payment Required” status. Unlike legacy payment rails built for human‑initiated purchases, x402 is architected to let AI agents settle value in stablecoins essentially enabling machine‑to‑machine payments as a native capability of digital protocols.

These changes are not incremental. They represent the alignment of three key forces:

Productivity leaps in AI tooling: With tools like Claude Code, agents are moving from reactive assistants to autonomous operational builders, capable of generating, debugging, and maintaining complex software stacks independently.

Economic agency for AI systems: Blockchain protocols and standards like x402 are emerging to support the economic layer of AI activity, ensuring that agents can pay for compute, data, APIs, and other resources without human involvement.

A shift toward autonomous digital markets: As AI agents begin transacting at scale — making microtransactions, settling service fees, and optimizing resource allocation — blockchains become a core infrastructure layer of the AI economy, not just a speculative asset class.

Taken together, these trends suggest we are entering a new season for crypto and AI integration — not centered on hype or narrative alone, but on real economic interoperability. Where past cycles treated crypto as a frontier for speculative capital, the next wave may be defined by crypto as the payments substrate for autonomous digital actors.

Silver vs Bitcoin (IBIT)

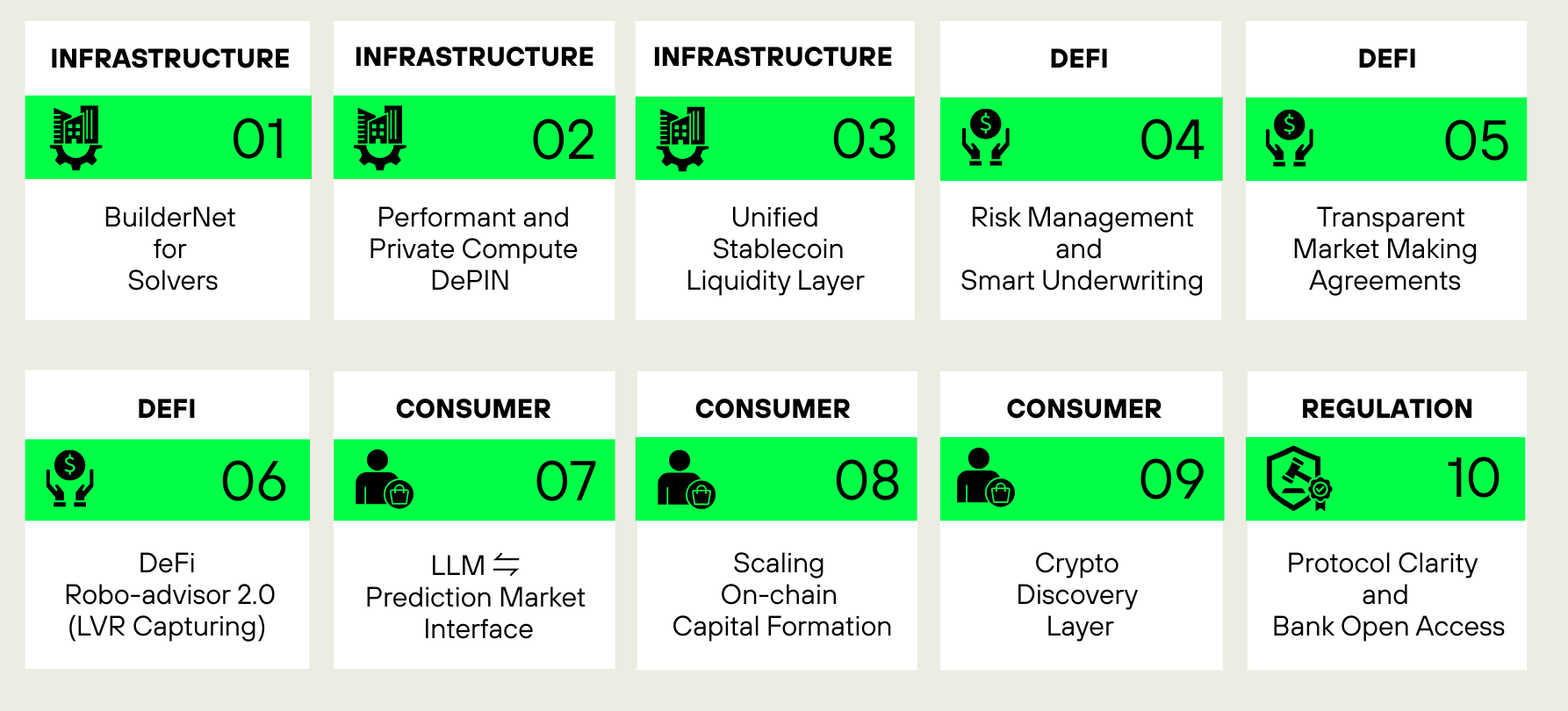

2026: What VCs Are Betting On

As we enter 2026, we have synthesized the most compelling predictions from 30+ institutions, including a16z, Pantera Capital, Grayscale, Bitwise, Galaxy Digital, and Dragonfly, to bring you the consensus view on where crypto is headed.

Prediction 1: Stablecoins Hit $1 Trillion

Stablecoins are forecasted to reach a trillion dollar market cap by end of 2026, representing a 3.3x increase from current levels.

But here is the bigger story: stablecoin transaction volume is expected to surpass the U.S. ACH system (the network that handles most American bank transfers, payroll deposits, and bill payments) in 2026. The narrative is shifting from "tokenization" to "origination". Institutions will begin originating debt directly on-chain, reducing loan servicing costs and increasing global accessibility.

Major card networks like Visa and Mastercard are projected to route over 10% of cross-border settlements through stablecoins on public chains. Stablecoin-backed cards are expected to grow by 1,000% this year.

Prediction 2: The Rise of AI Agents as Economic Actors

2026 marks the birth of the agentic economy. AI agents are becoming major economic participants, and crypto provides the critical missing infrastructure.

Here is the bottleneck: In financial services, non-human identities already outnumber human employees 96 to 1, yet these identities remain "unbanked." Enter Know Your Agent (KYA), a framework for cryptographically signed credentials that link an AI agent to its principal, constraints, and liability.

According to Ribbit Capital’s token letter, KYA will be bigger than KYC

The industry is coalescing around the x402 payment protocol, enabling agents to conduct high-frequency micropayments for data, GPU time, and API calls instantly and permissionlessly. By 2026, AI agent payments could account for roughly 30% of daily transaction volume on certain protocols (Read our x402 newsletter edition to learn more).

Prediction 3: The Death of the Four-Year Cycle

Perhaps the most significant shift: the traditional Bitcoin halving cycle is officially obsolete.

With spot ETPs now live and corporate treasuries allocating to digital assets, institutional demand is outpacing new supply issuance. Bitcoin's volatility is expected to fall below that of Nvidia in 2026, signaling its transition into a mature macro asset.

Who's calling the end of the four-year cycle?

Grayscale: In a December 2025 report, wrote that "2026 will mark the end of the apparent four-year cycle," citing sustained institutional demand as the new price driver

Bitwise: Argues that institutional adoption and regulatory progress will outweigh pullback expectations tied to the traditional halving cycle

Bernstein: States the "Bitcoin cycle has broken the 4-year pattern and is now in an elongated bull cycle with more sticky institutional buying"

Changpeng Zhao (Binance founder): Declared at Bitcoin MENA in December that "the halving cycle seems to have ended"

Cathie Wood (ARK Invest): Concurs that institutional flows have fundamentally altered market dynamics

Bitcoin price targets from leading firms:

Bernstein: $150,000 in 2026, peaking at $200,000 in 2027

Dragonfly Capital: Above $150,000 by end of 2026

Standard Chartered: $150,000 by end of 2026 (revised down from earlier $300,000 target)

JPMorgan: $170,000 implied fair value based on volatility-adjusted BTC-to-gold framework

VanEck: $150,000 in 2026, with cycle potentially peaking at $200,000 in 2027

Galaxy Digital: $250,000 by end of 2027 (2026 remains "too chaotic to predict")

Citi (bear case): $78,000 as lower bound for 2026

The market now "rhymes more with 1996 than 1999." We are in the early innings of genuine technological penetration, not the eve of a bubble.

Prediction 4: DeFi Consolidation and the Tokenomics 2.0 Era

DeFi is evolving beyond yield farming into durable, revenue-tied models where tokenholder economics are linked directly to platform performance through fee sharing, buybacks, and burn mechanisms.

Key predictions for the DeFi landscape:

Perpetual DEX market share consolidates into roughly 3 dominant venues controlling 90% of volume

DEX spot trading volume exceeds 25% of total market volume

Equity perps account for 20%+ of total DeFi perp volume, providing 24/7 leveraged access to equity markets

Prediction market yearly volume hits $100 billion, with Polymarket leading the charge

Prediction 5: Privacy Becomes a Primary Chain Differentiator

For most chains, privacy has been an afterthought. In 2026, it becomes the ultimate moat.

The total market cap of privacy-focused tokens is expected to exceed $100 billion this year. Institutional adoption is driving a surge in zero-knowledge proofs and fully homomorphic encryption, as both users and institutions demand greater control over confidentiality.

Without native privacy, moving the world's finance on-chain remains a non-starter. The chains that solve this first will capture lasting lock-in.

Regulatory Outlook:

The regulatory environment is shifting from adversarial to constructive. After years of enforcement-first approaches, 2026 is shaping up to be the year policy catches up with reality.

Where we stand:

The GENIUS Act, passed in 2025, established the first federal-level regulatory framework for payment stablecoins and digital assets in the United States

SEC leadership changes have opened the door to clearer guidance on which tokens constitute securities and how broker-dealers can interact with blockchains

Security infrastructure is now "light-years ahead" of the early crypto era, with institutional-grade custody, MPC wallets, and on-chain risk controls becoming standard

Traditional financial firms like Goldman Sachs and Charles Schwab are actively preparing to enter spot crypto markets, anticipating regulatory clarity

What to watch:

Progress on the Clarity Act, which would establish clear definitions for which tokens qualify as securities vs. commodities

SEC rulemaking on how broker-dealers can custody and trade digital assets

Potential amendments to the GENIUS Act expanding its scope beyond stablecoins

State-level developments as more jurisdictions follow Wyoming's lead on digital asset frameworks

The Bottom Line

2026 is not a year of dramatic break from the past. It is the logical continuation of structural shifts that began in 2024 and 2025. The industry is moving from expectations to production, with pilot programs scaling and capital consolidating into established, compliant venues.

For end users, expect a more seamless experience where blockchain infrastructure becomes increasingly invisible but functionally essential to the movement of value and trust online.